YieldCurve: Interest Rate Curve Case Study

Less than 1 minute

YieldCurve: Interest Rate Curve Case Study

Visit the Mathema Option Pricing System for foreign exchange options and structured product valuation!

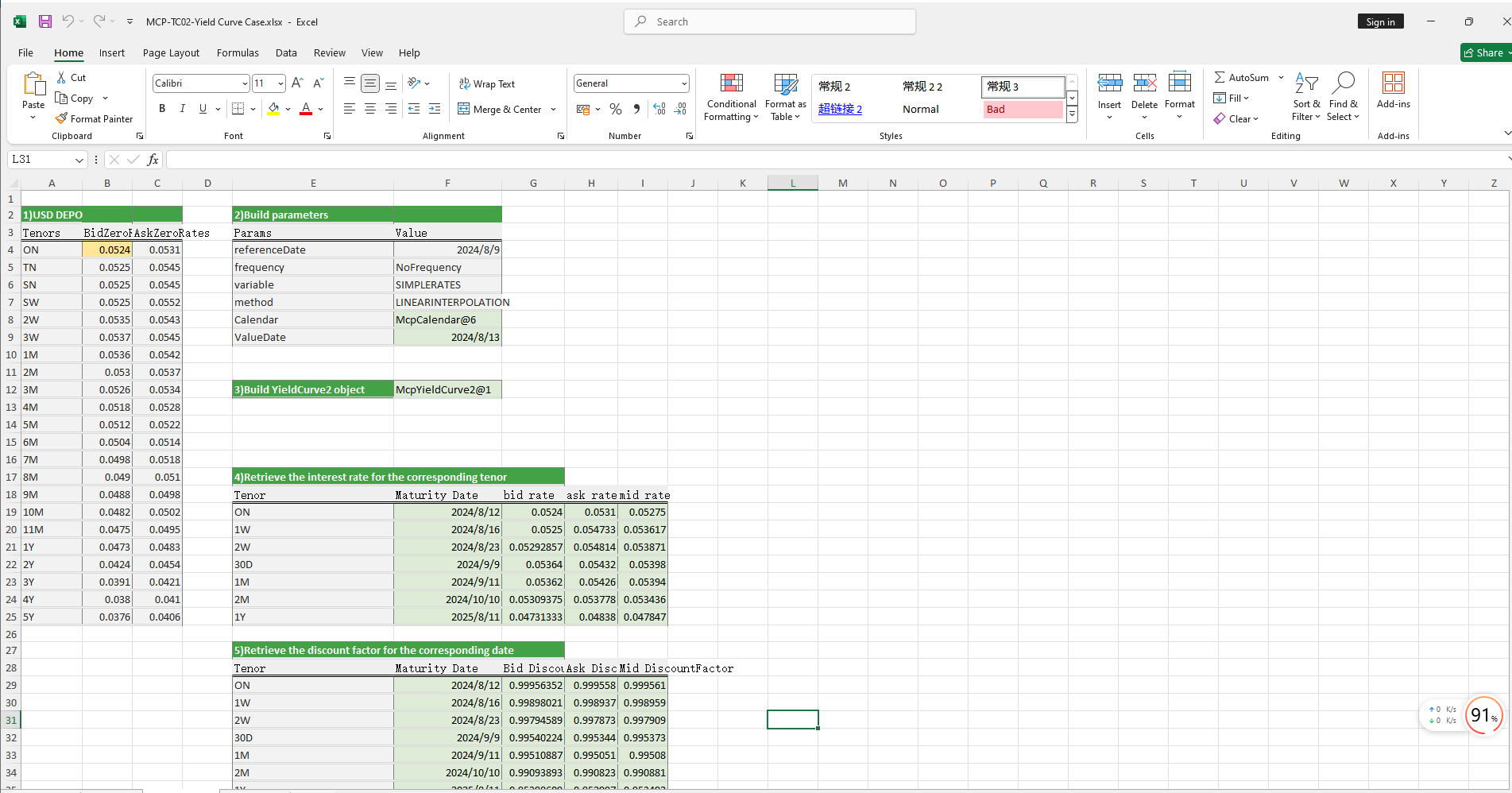

The YieldCurve case study provides methods for constructing both single-sided and double-sided yield curves, as well as extracting interest rates and discount factors for specified maturities from the yield curve.

Click the image below to download the template:

YieldCurve Case Study Template: Function Descriptions

1. Holiday Calendar Construction Functions

- McpCalendar:Constructs a holiday calendar object for one or more currency pairs.

- McpNCalendar:Constructs a holiday calendar object for multiple currencies.

2. YieldCurve Construction Functions

- McpYieldCurve2: Constructs a double-sided YieldCurve object.

- McpYieldCurve:Constructs a single-sided YieldCurve object.

3. Maturity Date Calculation Functions

- CalendarFXOExpiryDateFromTenor:Calculates the expiry date based on the given tenor.

4. YieldCurve Interest Rate Extraction Functions

- YieldCurve2ZeroRate: Retrieves the interest rate for a specified maturity date from a double-sided YieldCurve.

- YieldCurveZeroRate:etrieves the interest rate for a specified maturity date from a single-sided YieldCurve.

5. YieldCurve Discount Factor Extraction Functions

- YieldCurve2DiscountFactor:Retrieves the discount factor for a specified maturity date from a double-sided YieldCurve.

- YieldCurveDiscountFactor:Retrieves the discount factor for a specified maturity date from a single-sided YieldCurve.