Forward Curve Case Study

Forward Curve Case Study

Visit the Mathema Option Pricing System for foreign exchange options and structured product valuation!

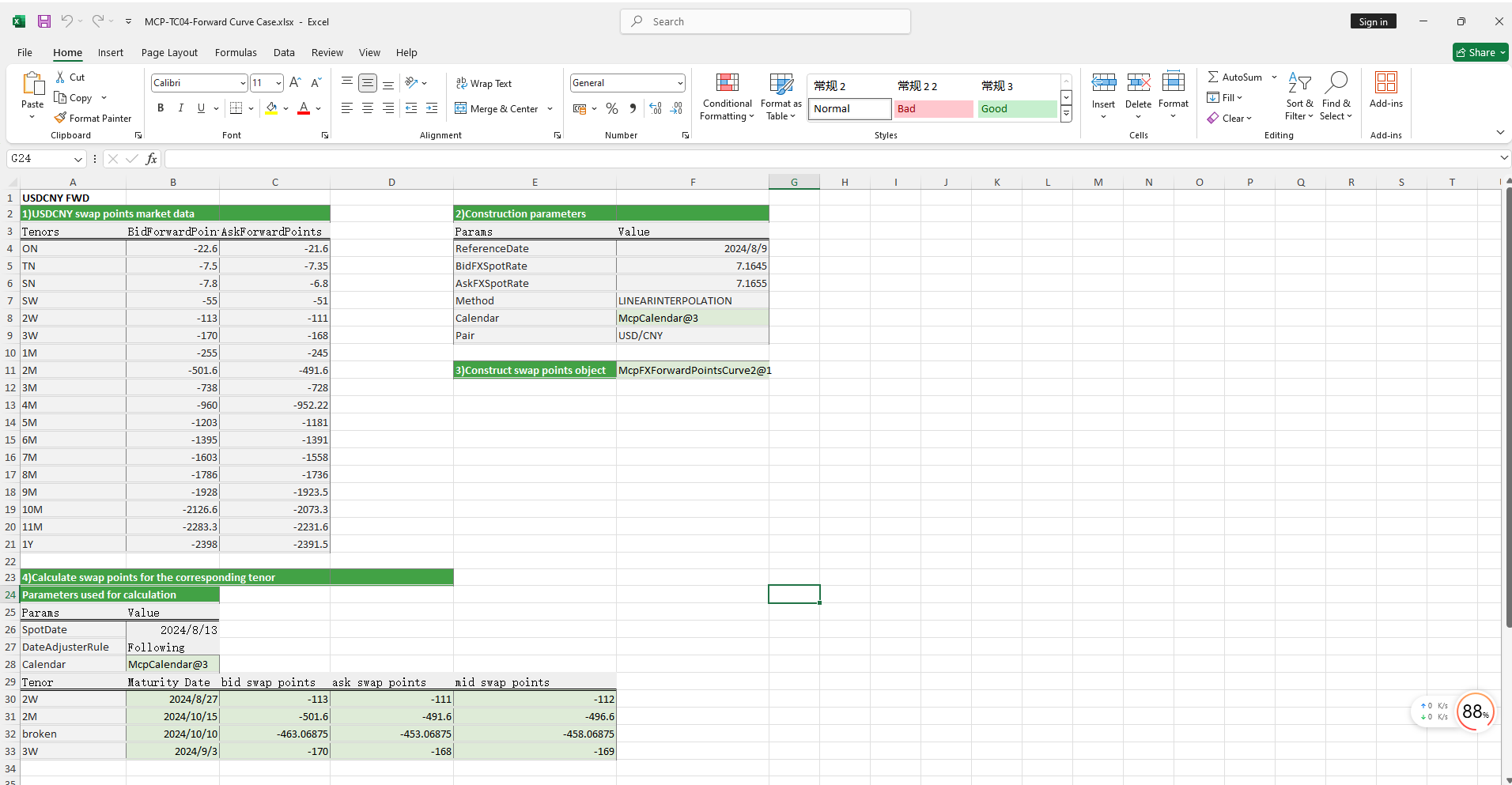

The Forward Curve case study provides methods for constructing forward curve objects, including both single-sided and double-sided approaches, as well as extracting swap points and forward prices for specified maturities from the forward curve.

Click the image below to download the template:

Forward Curve Case Study Template: Function Descriptions

1. Holiday Calendar Construction Functions

- McpCalendar: Constructs a holiday calendar object for one or more currency pairs.

- McpNCalendar: Constructs a holiday calendar object for multiple currencies.

2. Maturity Date Calculation Functions

- CalendarAddPeriod: Calculates the maturity date.

3. Forward Curve Construction Functions

- McpFXForwardPointsCurve2: Constructs a double-sided forward curve object.

- McpFXForwardPointsCurve: Constructs a single-sided forward curve object.

4. Forward Curve Data Extraction Functions

- Fxfpc2FXForwardPoints:Retrieves swap points from a double-sided forward curve object.

- Fxfpc2FXForwardOutright:Retrieves forward prices from a double-sided forward curve object.

- FxfpcFXForwardPoints:Retrieves swap points from a single-sided forward curve object.

- FxfpcFXForwardOutright:Retrieves forward prices from a single-sided forward curve object.

Python Code Example

Below is an example of a forward curve implementation.

Forward Curve Example

This example demonstrates how to use the McpFXForwardPointsCurve2 class from the mcp.tool.tools_main module to build a forward points curve. It calculates forward points and forward prices for different tenors and compares the results with expected values.

Dependencies

pandas: Used for data manipulation and comparison.example.calendar.calendar_demo: Used for calendar-related functionalities.mcp.enums: Used for date adjustment rules.mcp.tool.tools_main: Used for theMcpFXForwardPointsCurve2class.

Example Overview

The example performs the following steps:

- Calendar Initialization: Initializes the calendar using USD and CNY dates.

- Forward Points Curve Construction: Builds the forward points curve using the

McpFXForwardPointsCurve2class with specified parameters. - Forward Points and Prices Calculation: Calculates the bid, ask, and mid forward points and forward prices for specified tenors.

- Data Comparison: Uses

pandas.DataFrameto compare the calculated results with expected values.

Code Explanation

Import Statements

import pandas as pd

from pandas._testing import assert_frame_equal

from example.calendar.calendar_demo import McpNCalendar, usd_dates, cny_dates

from mcp.enums import DateAdjusterRule

from mcp.tool.tools_main import McpFXForwardPointsCurve2Function: Forward Points Curve Construction and Calculation

This example tests the construction and calculation of the forward points curve.

def test_forward_points_curve2_with_bidask():

cal = McpNCalendar(['USD', 'CNY'], [usd_dates, cny_dates])

args = {

'ReferenceDate': '2024-8-9',

'Tenors': ['ON', 'TN', 'SN', 'SW', '2W', '3W', '1M', '2M', '3M', '4M', '5M', '6M', '7M', '8M', '9M', '10M',

'11M', '1Y'],

'BidForwardPoints': [-22.6, -7.5, -7.8, -55, -113, -170, -255, -501.6, -738, -960, -1203, -1395, -1603, -1786,

-1928, -2126.6, -2283.3, -2398],

'AskForwardPoints': [-21.6, -7.35, -6.8, -51, -111, -168, -245, -491.6, -728, -952.22, -1181, -1391, -1558,

-1736, -1923.5, -2073.3, -2231.6, -2391.5],

"BidFXSpotRate": 7.1645,

"AskFXSpotRate": 7.1655,

"Method": 'LINEARINTERPOLATION',

"Pair": 'USD/CNY',

'Calendar': cal,

}

curve = McpFXForwardPointsCurve2(args)

spot_date = cal.ValueDate('2024-8-9')

tenors = ['2W', '2M', 'broken', '3W']

expire_dates = []

bid_points = []

ask_points = []

mid_points = []

bid_pxs = []

ask_pxs = []

mid_pxs = []

for tenor in tenors:

if tenor == 'broken':

ex_date = '2024-10-10'

else:

ex_date = cal.AddPeriod(spot_date, tenor, DateAdjusterRule.Following)

expire_dates.append(ex_date)

bid_point = curve.FXForwardPoints(ex_date, 'BID')

ask_point = curve.FXForwardPoints(ex_date, 'ASK')

mid_point = curve.FXForwardPoints(ex_date, 'MID')

bid_points.append(bid_point)

ask_points.append(ask_point)

mid_points.append(mid_point)

bid_px = curve.FXForwardOutright(ex_date, 'BID')

ask_px = curve.FXForwardOutright(ex_date, 'ASK')

mid_px = curve.FXForwardOutright(ex_date, 'MID')

bid_pxs.append(bid_px)

ask_pxs.append(ask_px)

mid_pxs.append(mid_px)

column_names = ['tenor', 'expire_date', 'bidpoints', 'askpoints', 'midpoints', 'bidpx', 'askpx', 'midpx']

p_data = [tenors, expire_dates, bid_points, ask_points, mid_points, bid_pxs, ask_pxs, mid_pxs]

r_dic = {}

for key, val in zip(column_names, p_data):

r_dic[key] = val

df = pd.DataFrame(r_dic)

expected_data = [

tenors,

['2024-08-27', '2024-10-15', '2024-10-10', '2024-09-03'],

[-113, -501.6, -463.06875, -170],

[-111, -491.6, -453.06875, -168],

[-112, -496.6, -458.06875, -169],

[7.1532, 7.11434, 7.118193125, 7.1475],

[7.1544, 7.11634, 7.120193125, 7.1487],

[7.1538, 7.11534, 7.119193125, 7.1481]

]

e_dic = {}

for key, val in zip(column_names, expected_data):

e_dic[key] = val

expected_df = pd.DataFrame(e_dic)

assert_frame_equal(df, expected_df, check_dtype=True)Expected Output

The example compares the calculated forward points and prices with the following expected values:

| Tenor | Expire Date | Bid Forward Points | Ask Forward Points | Mid Forward Points | Bid Price | Ask Price | Mid Price |

|---|---|---|---|---|---|---|---|

| 2W | 2024-08-27 | -113 | -111 | -112 | 7.1532 | 7.1544 | 7.1538 |

| 2M | 2024-10-15 | -501.6 | -491.6 | -496.6 | 7.11434 | 7.11634 | 7.11534 |

| broken | 2024-10-10 | -463.06875 | -453.06875 | -458.06875 | 7.118193125 | 7.120193125 | 7.119193125 |

| 3W | 2024-09-03 | -170 | -168 | -169 | 7.1475 | 7.1487 | 7.1481 |