Volatility Case Study

Volatility Case Study

Visit the Mathema Option Pricing System for foreign exchange options and structured product valuation!

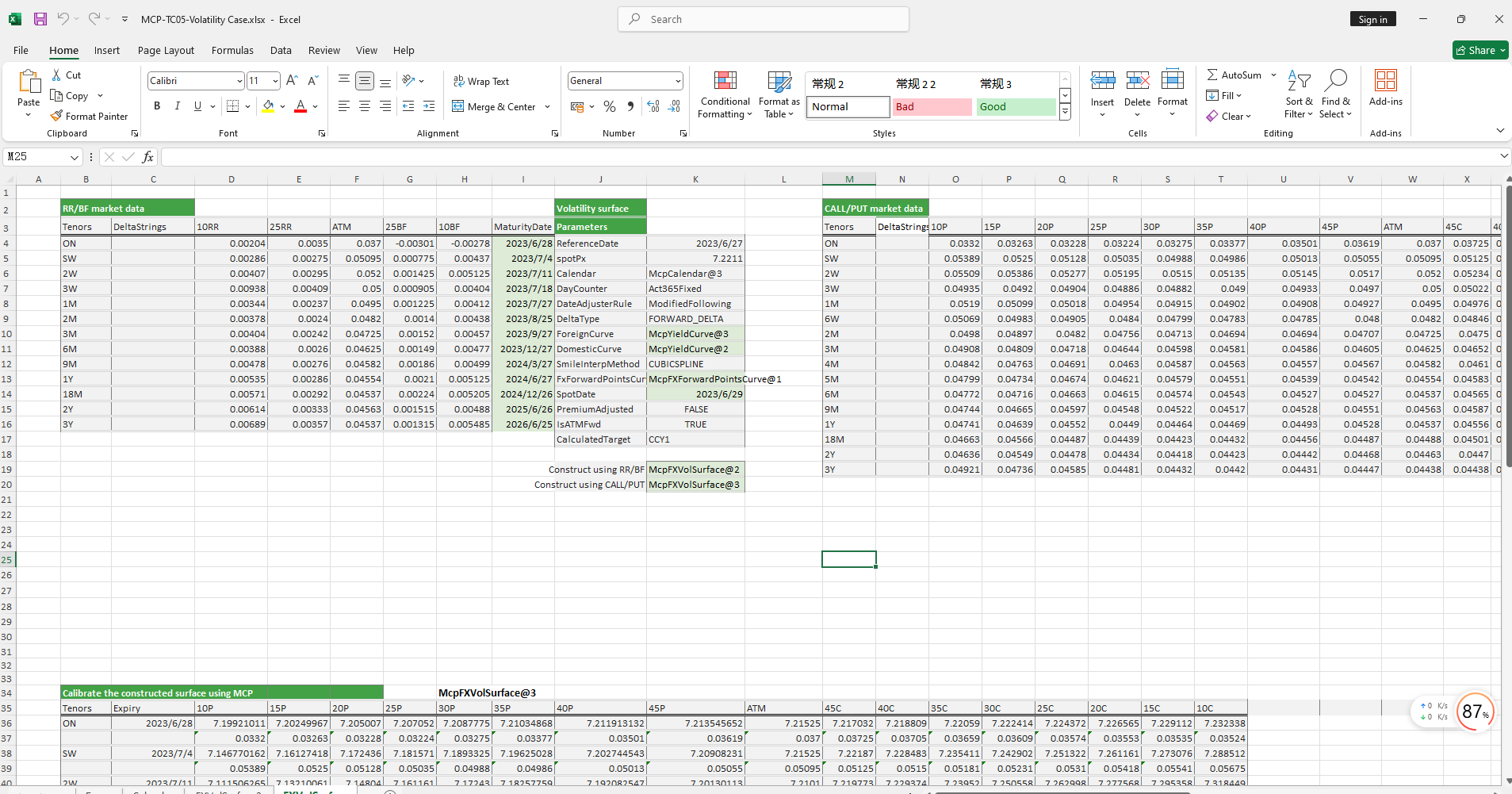

The Volatility case study provides methods for constructing volatility objects, including both single-sided and double-sided approaches, as well as extracting ATM volatility, interest rates, swap points, forward prices, and volatility for specified maturities from the volatility surface.

Click the image below to download the template:

Volatility Case Study Template: Function Descriptions

1. Holiday Calendar Construction Functions

- McpCalendar: Constructs a holiday calendar object for one or more currency pairs.

- McpNCalendar: Constructs a holiday calendar object for multiple currencies.

2. Maturity Date Calculation Functions

- CalendarFXOExpiryDateFromTenor: Calculates the expiry date based on the given tenor.

3. Double-Sided Construction Methods

- Yield Curve Object

- McpYieldCurve2: Constructs a yield curve object.

- Forward Curve Object

- McpFXForwardPointsCurve2: Constructs a forward curve object.

- Volatility Surface Object

- McpFXVolSurface2: Constructs a volatility surface object.

- Volatility Surface Data Extraction

- FXVolSurface2GetReferenceDate: Retrieves the reference date of the volatility surface.

- FXVolSurface2GetSpotDate: Retrieves the spot date of the volatility surface.

- FXVolSurface2GetSpot: Retrieves the spot price from the volatility surface.

- FXVolSurface2GetStrike: Retrieves the strike for a given tenor and DeltaString.

- FXVolSurface2GetVolatility: Retrieves the volatility for a given strike and expiry date.

- FXVolSurface2GetATMVol: Retrieves the ATM volatility for a given expiry date.

- FXVolSurface2GetForeignRate: Retrieves the CCY1 interest rate for a given expiry date.

- FXVolSurface2GetDomesticRate: Retrieves the CCY2 interest rate for a given expiry date.

- FXVolSurface2GetForwardPoint: Retrieves the swap points for a given expiry date.

- FXVolSurface2GetForward: Retrieves the forward price for a given expiry date.

4. Single-Sided Construction Methods

- Yield Curve Object

- McpYieldCurve: Constructs a yield curve object.

- Forward Curve Object

- McpFXForwardPointsCurve: Constructs a forward curve object.

- Volatility Surface Object

- McpFXVolSurface: Constructs a volatility surface object.

- Volatility Surface Data Extraction

- FXVolSurfaceGetStrike: Retrieves the strike for a given tenor and DeltaString.

- FXVolSurfaceGetVolatility: Retrieves the volatility for a given strike and expiry date.

- FXVolSurfaceGetReferenceDate: Retrieves the reference date of the volatility surface.

- FXVolSurfaceGetSpotDate: Retrieves the spot date of the volatility surface.

- FXVolSurfaceGetSpot: Retrieves the spot price from the volatility surface.

- FXVolSurfaceGetATMVol: Retrieves the ATM volatility for a given expiry date.

- FXVolSurfaceGetForeignRate: Retrieves the CCY1 interest rate for a given expiry date.

- FXVolSurfaceGetDomesticRate: Retrieves the CCY2 interest rate for a given expiry date.

- FXVolSurfaceGetForwardPoint: Retrieves the swap points for a given expiry date.

- FXVolSurfaceGetForward: Retrieves the forward price for a given expiry date.

Python Code Example

Below is an example of a volatility surface implementation.

Volatility Surface Example Code

This example code demonstrates how to use the mcp library to build and test a volatility surface. The code includes the test_mkt_vol_surface2 function, which tests the volatility surface based on the US Dollar (USD) and Chinese Yuan (CNY).

1. test_mkt_vol_surface2

This function tests the volatility surface based on USD and CNY. Below are the main steps of the code:

1.1 Create Calendar Objects

First, calendar objects for USD and CNY are created:

cal = McpNCalendar(['USD', 'CNY'], [usd_dates, cny_dates])

cal_usd = GetCurrencyCalendar('USD', 'USD', usd_dates)

cal_cny = GetCurrencyCalendar('CNY', 'CNY', usd_dates)1.2 Build Yield Curves

Next, yield curves for USD and CNY are constructed:

yc_args_usd = {

'ReferenceDate': '2024-12-13',

'Tenors': ['ON', 'TN', 'SN', 'SW', '2W', '3W', '1M', '2M', '3M', '4M', '5M', '6M', '7M', '8M', '9M', '10M', '11M', '1Y', '2Y', '3Y', '4Y', '5Y'],

'BidZeroRates': [0.0458, 0.0439, 0.045, 0.0439, 0.0433, 0.046, 0.0433, 0.0433, 0.0433, 0.0435, 0.0435, 0.0433, 0.0434, 0.0434, 0.0433, 0.0433, 0.0433, 0.0433, 0.044, 0.043, 0.042, 0.042],

'AskZeroRates': [0.0459, 0.0451, 0.0457, 0.0451, 0.0458, 0.0553, 0.0458, 0.0458, 0.0458, 0.046, 0.046, 0.0458, 0.0459, 0.0459, 0.0458, 0.0458, 0.0458, 0.0458, 0.0465, 0.046, 0.045, 0.045],

'Calendar': cal_usd,

'ShortName': 'USDSofrSnapYldCurve',

'Symbol': 'USD',

'DayCount': None,

'Frequency': '-1',

'Variable': 'SIMPLERATES',

'InterpolationMethod': None

}

yc_args_cny = {

'ReferenceDate': '2024-12-13',

'Tenors': ['ON', '1W', '2W', '1M', '3M', '6M', '9M', '1Y'],

'BidZeroRates': [0.01404, 0.01758, 0.0187, 0.0171, 0.01735, 0.01744, 0.01759, 0.01774],

'AskZeroRates': [0.01404, 0.01758, 0.0187, 0.0171, 0.01735, 0.01744, 0.01759, 0.01774],

'Calendar': cal_cny,

'ShortName': 'CNYShibor3mSnapYldCurve',

'Symbol': 'CNY',

'DayCount': None,

'Frequency': '-1',

'Variable': 'SIMPLERATES',

'InterpolationMethod': None

}

yc1 = McpYieldCurve2(yc_args_usd)

yc2 = McpYieldCurve2(yc_args_cny)1.3 Build Forward Points Curve

Then, the forward points curve for USD/CNY is constructed:

fw_args = {

'ReferenceDate': '2024-12-13',

'Tenors': ['SW', '2W', '3W', '1M', '2M', '3M', '4M', '5M', '6M', '7M', '8M', '9M', '10M', '11M', '1Y', '18M', '2Y', '3Y', '4Y', '5Y'],

'BidForwardPoints': [-39.5, -77.0, -116.0, -177.0, -360.35, -522.77, -709.23, -922.0, -1124.52, -1328.0, -1531.0, -1749.28, -1940.0, -2145.0, -2388.0, -3450.0, -4330.0, -5696.61, -6000.0, -8050.0],

'AskForwardPoints': [-35.5, -75.2, -114.0, -167.0, -348.43, -509.23, -704.0, -915.0, -1105.48, -1283.0, -1486.0, -1724.72, -1896.6, -2103.3, -2358.0, -2860.0, -4230.0, -5463.39, -4900.0, -7550.0],

'BidFXSpotRate': 7.2768,

'AskFXSpotRate': 7.277,

'Pair': 'USD/CNY',

'Calendar': cal,

'ShortName': 'USDCNYFwdSnapCurve',

'Symbol': 'USD/CNY',

'InterpolationMethod': 'LINEARINTERPOLATION'

}

fc = McpFXForwardPointsCurve2(fw_args)1.4 Build Volatility Surface

The volatility surface for USD/CNY is then constructed:

vol_args = {

'ShortName': 'USDCNYRSnapVolSurface',

'Symbol': 'USD/CNY',

'DayCounter': 'Act365Fixed',

'DateAdjusterRule': 'ModifiedFollowing',

'DeltaType': 'FORWARD_DELTA',

'UndCurve': 'USDSofrSnapYldCurve',

'AccCurve2': yc2,

'SmileInterpMethod': 'CUBICSPLINE',

'FxForwardPointsCurve': 'USDCNYFwdSnapCurve',

'PremiumAdjusted': 'FALSE',

'IsATMFwd': 'TRUE',

'CalculatedTarget': 'CCY1',

'ReferenceDate': '2024-12-13',

'DeltaStrings': ['10DPUT', '15DPUT', '20DPUT', '25DPUT', '30DPUT', '35DPUT', '40DPUT', '45DPUT', 'ATM', '45DCAL', '40DCAL', '35DCAL', '30DCAL', '25DCAL', '20DCAL', '15DCAL', '10DCAL'],

'Tenors': ['SW', '2W', '3W', '1M', '2M', '3M', '4M', '5M', '6M', '9M', '1Y', '18M', '2Y'],

'BidVolatilities': '0.05131,0.04998,0.04866,0.04734,0.04603,0.04478,0.04361,0.04258,0.04175,0.04108,0.04062,0.04035,0.04026,0.04034,0.04058,0.04092,0.04131;...',

'AskVolatilities': '0.06631,0.06498,0.06366,0.06234,0.06103,0.05978,0.05861,0.05758,0.05675,0.05608,0.05562,0.05535,0.05526,0.05534,0.05558,0.05592,0.05631;...',

'FxForwardPointsCurve2': fc,

'UndCurve2': yc1,

'Calendar': cal

}

mkt_vol: MMktVolSurface2 = McpMktVolSurface2(vol_args)1.5 Retrieve Foreign Rates

Finally, foreign rates for a specified expiry date are retrieved:

expiryDate = '2024-12-18'

strike = 7

ForeignRate = mkt_vol.GetForeignRate(expiryDate, False, 'BID')

DomesticRate = mkt_vol.GetDomesticRate(expiryDate, False, 'BID')