FX Barrier Option Pricing Case Study

About 2 min

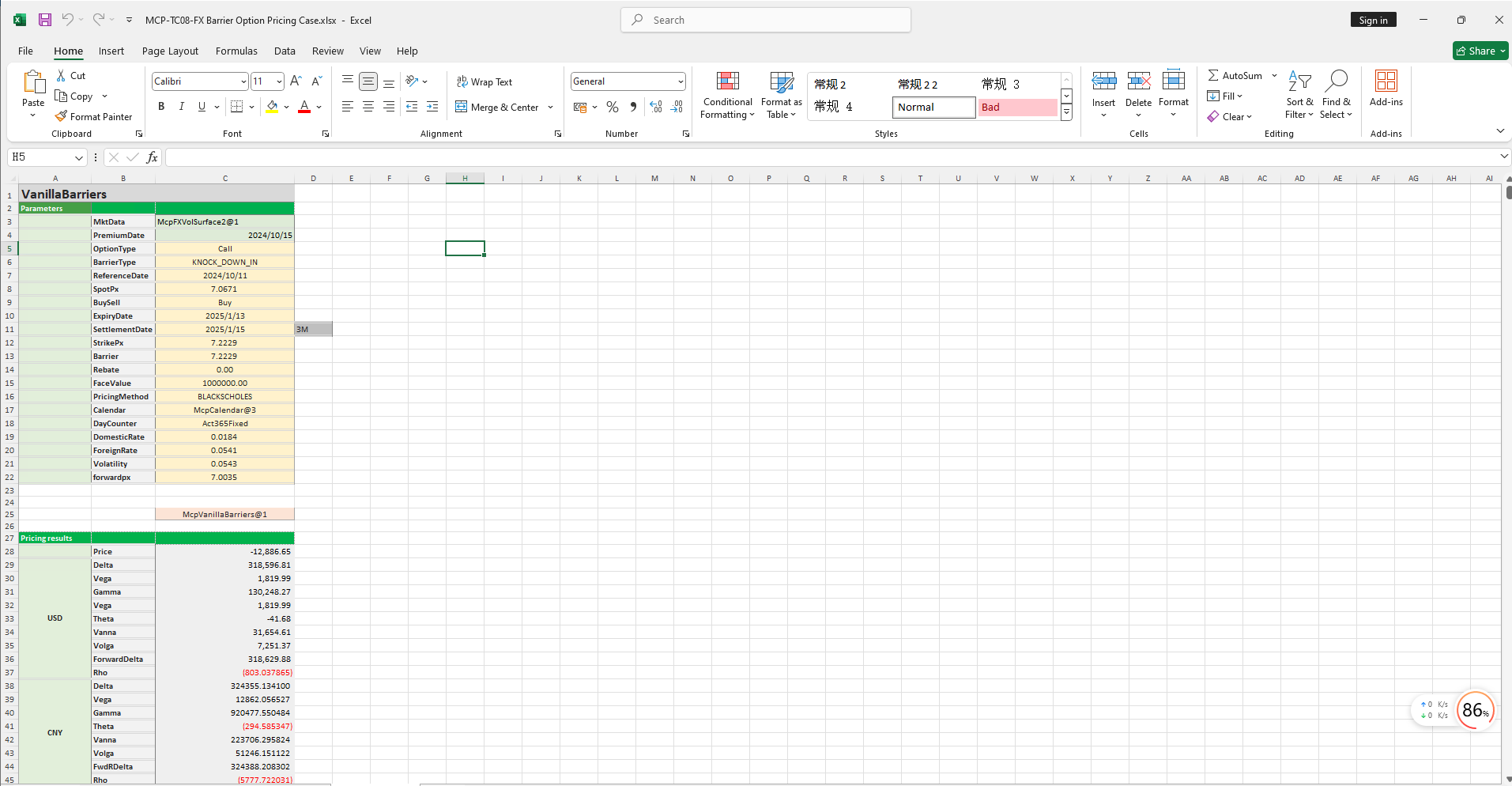

FX Barrier Option Pricing Case Study

Visit the Mathema Option Pricing System for foreign exchange options and structured product valuation!

The FX Barrier Option Pricing template provides a comprehensive workflow for holiday management, yield curve construction, volatility surface construction, barrier option object creation, date calculation, option pricing, and Greek value calculation. It enables precise modeling, pricing, and risk analysis of barrier options.

Click the image below to download the template:

FX Barrier Option Pricing Template: Function Descriptions

1. Holiday Calendar Construction Functions

- McpCalendar: Constructs a holiday calendar object for one or more currency pairs.

- McpNCalendar: Constructs a holiday calendar object for multiple currencies.

2. Yield Curve Construction Functions

- McpYieldCurve2: Constructs a yield curve object.

3. Forward Curve Construction Functions

- McpFXForwardPointsCurve2: Constructs a forward curve object.

4. Volatility Surface Construction Functions

- McpFXVolSurface2: Constructs a volatility surface object.

5. Barrier Option Construction Functions

- McpVanillaBarriers: Constructs a barrier option object.

6. Volatility Surface Related Functions

- FXVolSurface2GetForeignRate: Retrieves the CCY1 interest rate for a given expiry date from the volatility surface.

- FXVolSurface2GetDomesticRate: Retrieves the CCY2 interest rate for a given expiry date from the volatility surface.

- FXVolSurface2GetForward: Retrieves the forward price for a given expiry date from the volatility surface.

- FXVolSurface2GetVolatility: Retrieves the volatility for a given strike and expiry date from the volatility surface.

7. Date Calculation Functions

- CalendarValueDate: Calculates the option premium payment date.

- CalendarFXOExpiryDateFromTenor: Calculates the expiry date.

- CalendarFXODeliveryDateFromTenor: Calculates the delivery date.

8. Option Premium Calculation Functions

- McpPrice: Calculates the option premium.