Case studies of functions related to server-side volatility construction

Less than 1 minute

Case studies of functions related to server-side volatility construction

Visit the Mathema Option Pricing System for foreign exchange options and structured product valuation!

The server-side provides constructors for related volatility measures such as foreign exchange, futures, indices, digital options, interest rate volatility, and CapFloor volatility.

Click the image below to download the template:

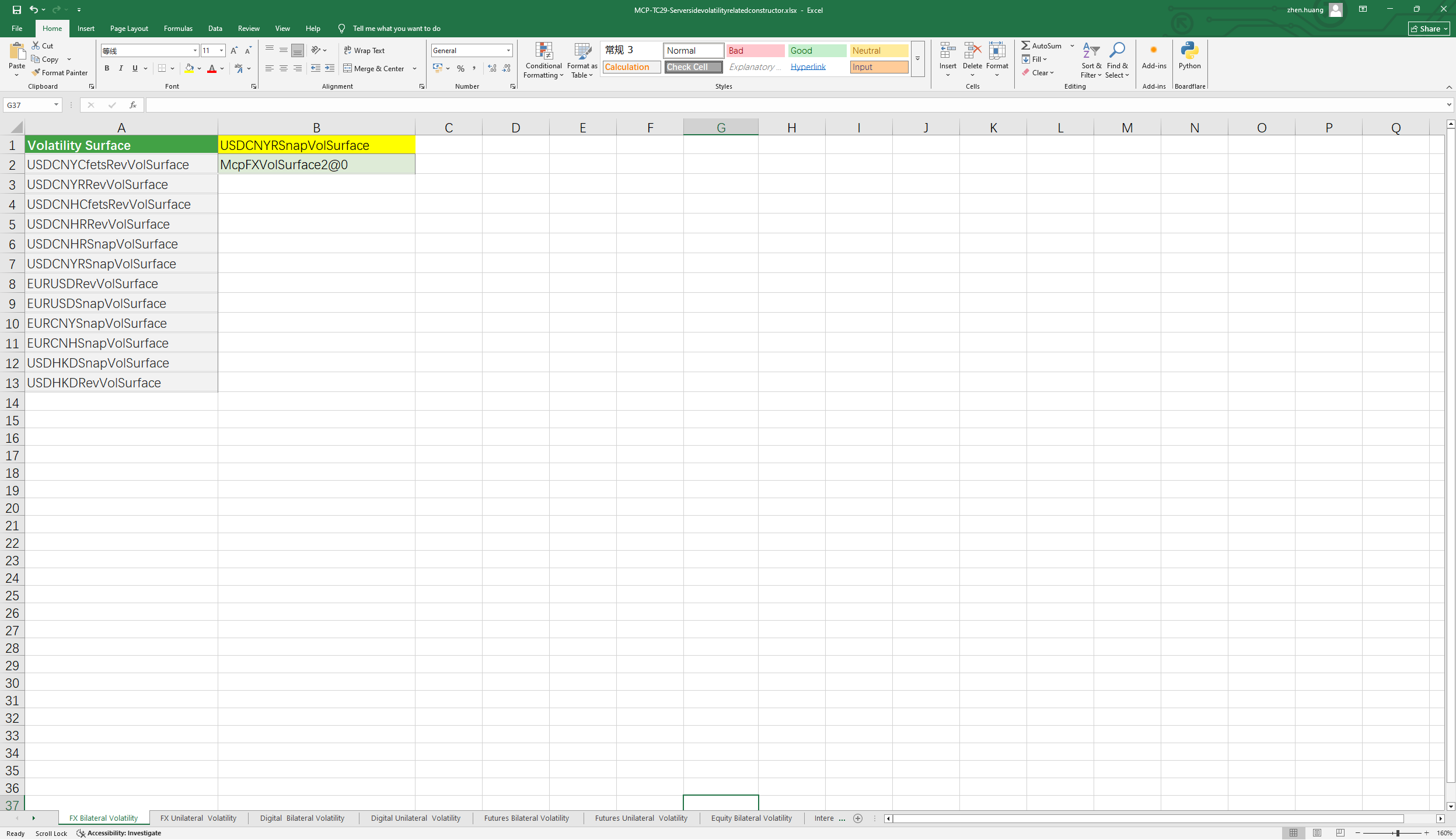

Server-Side Object Construction via Forward Curve Short Names and Volatility Surface Short Names and Application Function Descriptions

1. Server-Side Foreign Exchange Volatility Constructor Functions

- McpFXVolSurface2ByName:Constructs a bilateral volatility surface on the server side using a volatility surface short name.

- McpFXVolSurfaceByName:Constructs a unilateral volatility surface on the server side using a volatility surface short name.

2. Server-Side Futures and Digital Currency Volatility Constructor Functions

- McpVolSurface2ByName:Constructs a bilateral volatility surface on the server side using an UNDERLYING identifier.

- McpVolSurfaceByName:Constructs a unilateral volatility surface on the server side using an UNDERLYING identifier.

3. Server-Side Commodity Index Volatility Surface Constructor Functions

- McpVolSurface2Equity:Constructs a bilateral volatility surface on the server side using an UNDERLYING identifier.

4. Server-Side Interest Rate Volatility and CapFloor Volatility Constructor Functions

- McpSwaptionCubes:Constructs an interest rate volatility surface on the server side using a volatility short name.

- McpCapVolSurface:Constructs a CapFloor volatility surface on the server side using a volatility short name.