Server-side Bond and Interest Rate Swap Calculator Case Study

About 2 min

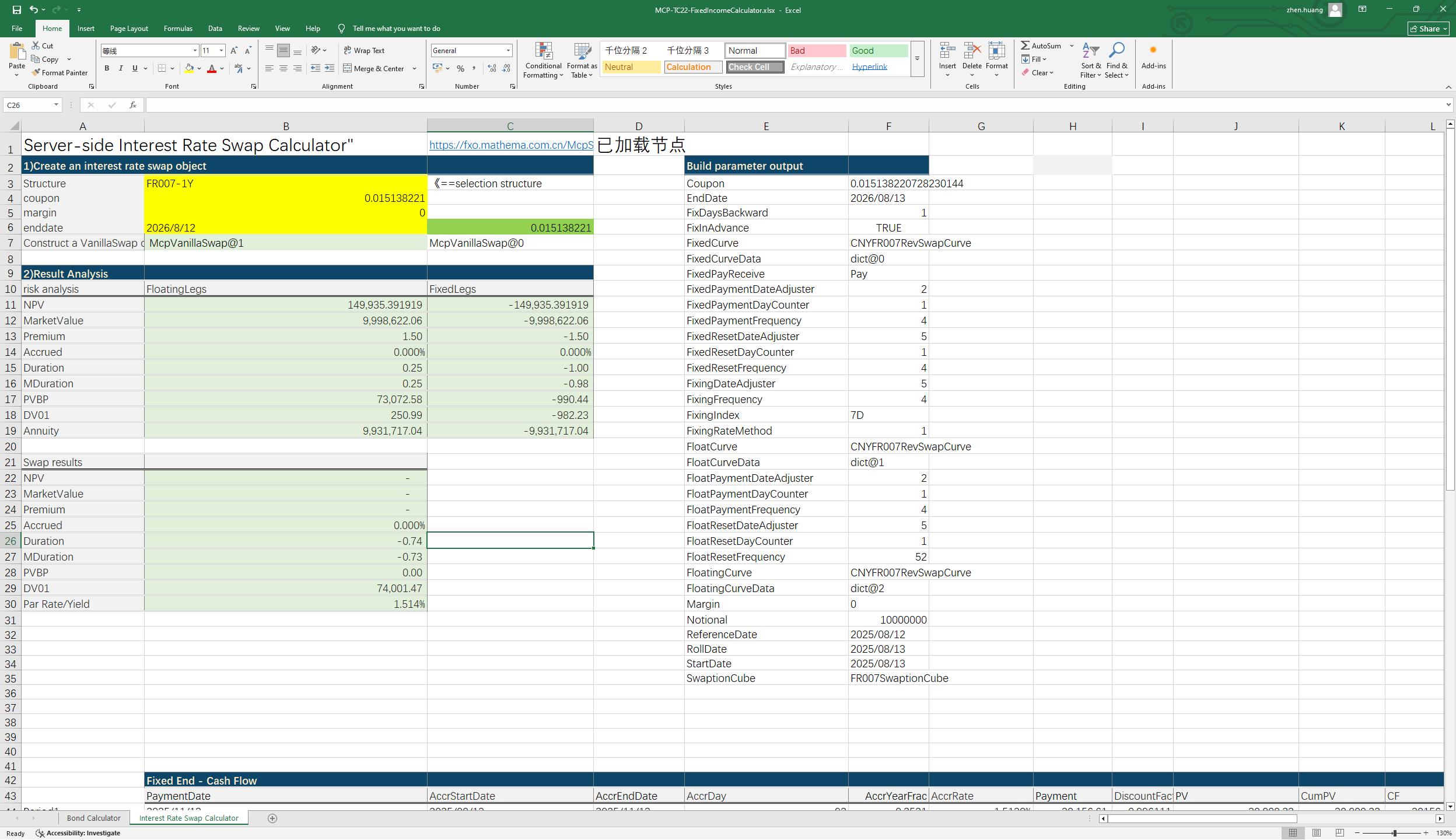

Server-side Bond and Interest Rate Swap Calculator Case Study

Visit the Mathema Option Pricing System for foreign exchange options and structured product valuation!

Server-side bond object construction and related functions for calculating yield, clean price, dirty price, duration, convexity, spread, and other metrics; server-side interest rate swap object construction, fixed-leg analysis, floating-leg analysis, and swap result analysis.

Click the image below to download the template:

Server-Side Construction of Bond Objects and Interest Rate Swap Objects Using Bond Codes and Structure Abbreviations, Along with Application Function Descriptions

1. Server-side bond object construction and function to retrieve the latest transaction price

- McpFixedRateBonds2:Constructor function for the server-side bond object。

- McpGet1:The server retrieves the latest transaction price for the specified bond code。

2. Price Calculation Functions

- FrbCleanPriceFromYieldCHN:Calculates the clean price based on the FixedRateBond object and yield.

- FrbDirtyPriceFromYieldCHN:Calculates the dirty price based on the FixedRateBond object and yield.

- FrbPrice:Calculates the dirty price based on the FixedRateBond object and BondCurve object.

3. Duration and Convexity Calculation Functions

- FrbDurationCHN:Calculates the Macaulay duration based on the FixedRateBond object and yield.

- FrbMDurationCHN:Calculates the modified duration based on the FixedRateBond object and yield.

- FrbConvexityCHN:Calculates the convexity based on the FixedRateBond object and yield.

4. PVBP Calculation Functions

- FrbPVBPCHN:Calculates the PVBP (Price Value of a Basis Point) based on the FixedRateBond object and yield.

5. Yield Calculation Functions

- FrbYieldFromDirtyPriceCHN:Calculates the yield based on the FixedRateBond object and dirty price.

6.Server-side Interest Rate Swap Object Constructor

- McpVanillaSwaps2:The server implements a VanillaSwap object via an IRS (Interest Rate Swap) framework.

7. Fixed Leg Analysis Functions

- SwapFixedLegAnnuity:Calculates the annuity.

- SwapFixedLegDuration:Calculates the duration.

- SwapFixedLegMDuration:Calculates the modified duration.

- SwapFixedLegNPV:Calculates the net present value (NPV).

- SwapFixedLegDV01:Calculates the DV01.

- SwapFixedLegPremium:Calculates the premium.

- SwapFixedLegAccrued:Calculates the accrued interest.

- SwapFixedLegMarketValue:Calculates the market value.

8. Floating Leg Analysis Functions

- SwapFloatingLegAnnuity:Calculates the annuity.

- SwapFloatingLegDuration:Calculates the duration.

- SwapFloatingLegMDuration:Calculates the modified duration.

- SwapFloatingLegNPV:Calculates the net present value (NPV).

- SwapFloatingLegDV01:Calculates the DV01.

- SwapFloatingLegPremium:Calculates the premium.

- SwapFloatingLegAccrued:Calculates the accrued interest.

- SwapFloatingLegMarketValue:Calculates the market value.

9. Swap Result Functions

- SwapNPV: Calculates the net present value (NPV).

- SwapMarketParRate:Calculates the Par Rate/Yield.

- SwapDuration:Calculates the duration.

- SwapMDuration:Calculates the modified duration.

- SwapPV01:Calculates the PVBP.

- SwapDV01:Calculates the DV01.

- SwapMarketValue:Calculates the market value.

- SwapAccrued:Calculates the accrued interest.

10. Pricing Functions

- SwapFixedLegs:Calculates the fixed leg cash flows.

- SwapFloatingLegs:Calculates the floating leg cash flows.

11. Fixing Frequency and Fixing Price Functions

- SwapFloatingQuotes:Calculates the floating leg fixing frequency and fixing price.

- SwapFloatingQuoteLegs:Calculates the floating leg fixing frequency and fixing price.