Normal vs. Lognormal Volatility

Normal vs. Lognormal Volatility

There are two common methods for measuring volatility: normal volatility and lognormal volatility.

Visit the Mathema Options Pricing System, supporting FX options and structured products pricing and valuation!

I. Introduction: Origins and Significance of the Two Volatility Paradigms

In the field of financial derivatives pricing and risk management, the way volatility is characterized fundamentally determines the behavior of models. Historically, two main paradigms for describing volatility have developed in parallel:

- Normal (Bachelier) Volatility: Proposed by Louis Bachelier in 1900, it measures the standard deviation of absolute price changes and applies to arithmetic Brownian motion.

- Lognormal (Black-Scholes) Volatility: Refined by Black, Scholes, and Merton in 1973, it is based on the standard deviation of logarithmic returns, corresponding to geometric Brownian motion.

These seemingly simple differences lead to profound distinctions in mathematical properties, market applicability, and risk management. This article systematically analyzes their theoretical foundations, calculation methods, conversion relationships, and practical applications.

II. Mathematical Essence and Core Formulas

1. Normal Volatility (σₙ)

Definition: Annualized standard deviation of absolute price changes

Stochastic Process:

Discrete Form:

Properties:

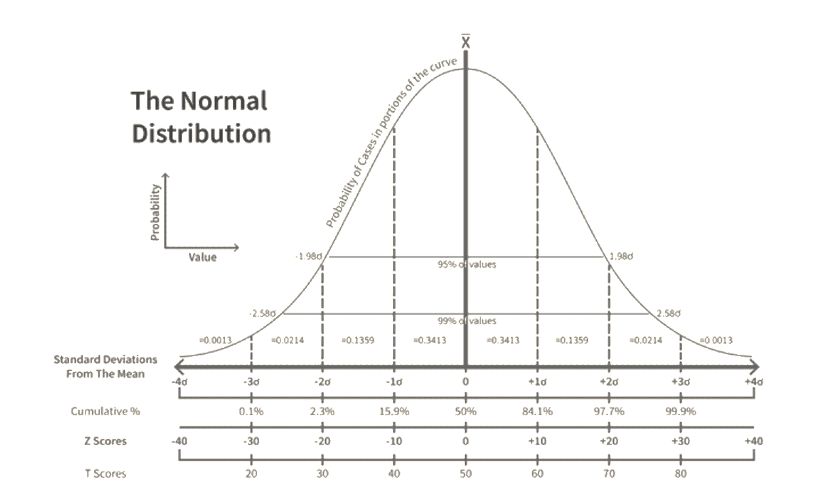

- Price changes ΔS follow a normal distribution.

- Negative prices are allowed.

- Volatility units match price units (e.g., USD/year).

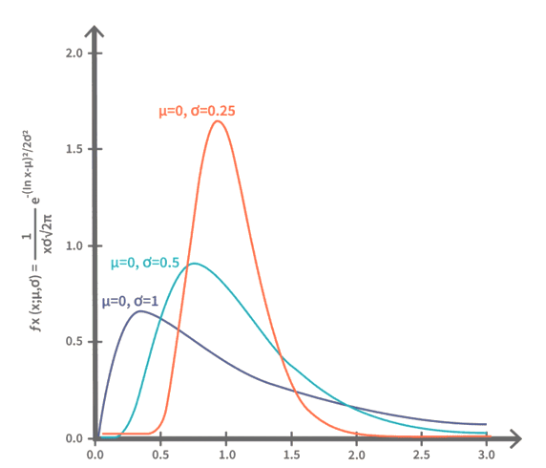

2. Lognormal Volatility (σₗₙ)

Definition: Annualized standard deviation of logarithmic returns

Stochastic Process:

Discrete Form:

Properties:

- Logarithmic returnsfollow a normal distribution.

- Prices are strictly positive.

- Volatility units are percentages (e.g., 20%/year).

3. Conversion Relationship

For short-term/small volatility conditions:

For precise conversion, convexity adjustment is required:

4. Brownian Motion and Its Relationship with the Two Models

1. Mathematical Basis of Brownian Motion

Brownian Motion (also known as Wiener Process) is the core stochastic process underlying both models, defined as:

Properties:

- Independent increments:is independent of historical paths.

- Normal distribution:.

- Continuous but non-differentiable paths.

2. Application in the Bachelier Model

The normal model directly uses the additive property of Brownian Motion:

- Economic Interpretation: Price changesare linear scalings of Brownian Motion increments.

- Discrete Form:

- Distribution Characteristics: Prices follow, preserving the possibility of negative values.

Example:

Ifbps/√year, the standard deviation of price changes after one day:

3. Transformation in the Black-Scholes Model

The lognormal model introduces multiplicative noise via logarithmic transformation:

- Economic Interpretation: Returnscombine drift terms with Brownian Motion.

- Discrete Form:

- Distribution Characteristics: Logarithmic prices follow a normal distribution, ensuring.

Example:

If, the standard deviation of returns after one day:

III. Comparison of Simple Option Pricing Formulas

1. Call Option Pricing

Bachelier (Normal) Model:

Black-Scholes (Lognormal) Model:

Example Calculation (S₀=100, K=105, T=1, r=0):

- Normal: σₙ=20 USD → C≈7.12

- Lognormal: σₗₙ=20% → C≈6.89

2. Put Option Pricing

Bachelier Model:

Black-Scholes Model:

IV. Market Quotation Examples

1. FX Market (Lognormal Convention)

Quotation Characteristics:

- Implied volatility quoted under the Black-Scholes model.

- Volatility surface uses Delta as the horizontal axis.

- Standard format example:

| Tenor | ATM | 25D RR | 25D BF |

|---|---|---|---|

| 1M | 11.2% | -0.5% | 0.7% |

| 1Y | 10.5% | -1.2% | 1.0% |

Where:

- ATM: At-the-money volatility.

- RR (Risk Reversal): Call-Put volatility spread.

- BF (Butterfly): Volatility convexity adjustment.

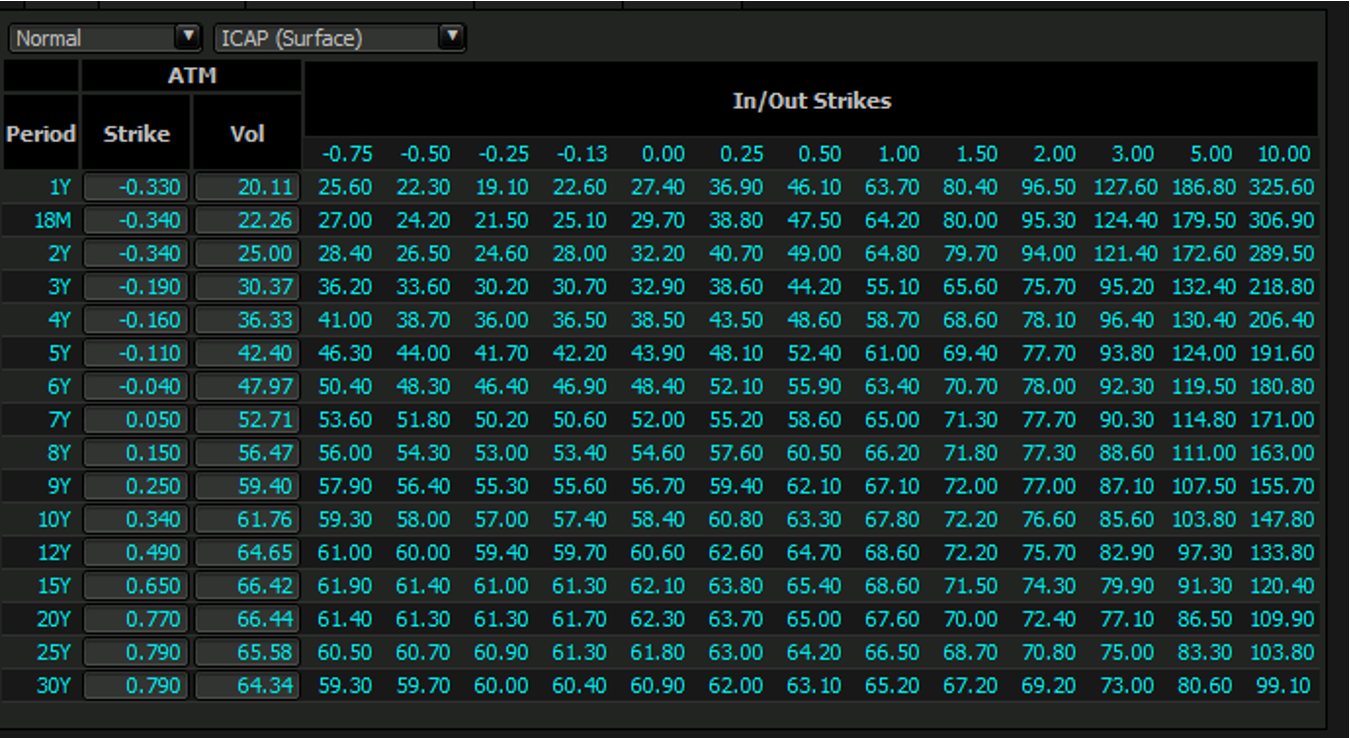

2. Interest Rate Market (Normal Convention)

Cap/Floor Quotations:

- Volatility typically quoted under the Bachelier model.

- In basis points (bps).

- Market data example:

(1) Column Definitions

| Column Name | Description |

|---|---|

| Period | Option tenor (1Y=1 year, 30Y=30 years, etc.) |

| Strike | Strike price of ATM option (in %, e.g., -0.340%=negative rates scenario) |

| Vol | Normal volatility of ATM option (in bps) |

| In/Out Strikes | Volatility quotes for different strikes (in bps), with strike intervals in %. |

(2) Example Analysis (1Y Tenor)

| Strike | -0.75% | -0.50% | ... | 10.00% |

|---|---|---|---|---|

| Vol | 27.00 | 24.20 | ... | 306.90 |

- Economic Meaning:

For a 1-year cap option with a strike of -0.75%, the market quotes a volatility of 27 bps (i.e., the annualized standard deviation of expected absolute rate changes is 0.27%).

Why Normal Volatility?

Interest rate markets use the Bachelier model (normal volatility) due to:

- Negative Rate Possibility: Negative strikes (e.g., -0.33%) cannot be handled by the lognormal model.

- Linear Sensitivity: DV01 (price change per 1bp rate move) aligns better with normal assumptions.

- Market Convention: Global interest rate options (e.g., Caps/Floors, Swaptions) typically quote volatility in bps.

V. Practical Volatility Conversion

FX Option Conversion Example

Given:

- EUR/USD spot = 1.1000

- 1Y ATM implied volatility = 12% (lognormal)

- Convert to normal volatility.

Calculation:

Precise Conversion (T=1):

Interest Rate Cap Conversion Example

Given:

- 3M LIBOR forward = 2.5%

- Normal volatility = 50 bps

- Convert to lognormal volatility.

Calculation:

Precise Conversion:

VI. Price Vol vs. Yield Vol: Key Relationships

Price Vol (price volatility) and Yield Vol (yield volatility) are two ways to measure asset price or yield fluctuations in financial markets. Their core differences lie in units of measurement and applicability, but they can be converted mathematically. Below is a detailed comparison and analysis of their relationship.

1. Definitions and Core Differences

| Type | Price Vol (Price Volatility) | Yield Vol (Yield Volatility) |

|---|---|---|

| Definition | Standard deviation of absolute price changes (e.g., USD, bps) | Standard deviation of percentage price changes (returns) (e.g., 20%) |

| Units | Same as price (e.g.,$5/year, 50 bps) | Percentage (e.g., 20%) |

| Model | Bachelier (Normal Model) | Black-Scholes (Lognormal Model) |

| Typical Markets | Interest rate derivatives (Caps/Floors), commodity options | Equities, FX, bond yield options |

| Negative Values? | Yes (e.g., negative rates) | No (logarithmic transformation ensures positivity) |

2. Mathematical Relationship

(1) Short-Term Approximation

For short-term or low-volatility scenarios, Price Vol (σₙ) and Yield Vol (σₗₙ) can be approximated as:

Examples:

- Stock price =$100, Yield Vol = 20% →

- Bond yield = 2%, Yield Vol = 10% →

(2) Precise Conversion (Convexity Adjustment)

For long-term or high-volatility scenarios, adjustments are needed:

Example:

- Stock price =$100, Yield Vol = 30%, T = 1 year →

3. Market Quotation Examples

(1) Interest Rate Market (Price Vol Dominant)

- Product: Interest rate cap.

- Quotation: 50 bps (standard deviation of absolute rate changes = 0.50%).

- Conversion: If current rate = 2%, equivalent Yield Vol ≈ 50 bps / 2% = 25%.

(2) Equity Market (Yield Vol Dominant)

- Product: Equity options.

- Quotation: 30% (annualized standard deviation of stock returns = 30%).

- Conversion: If stock price =$100, equivalent Price Vol ≈$30/year.

VII. Market Conventions Summary

| Market Type | Default Volatility Type | Typical Quotation | Major Products |

|---|---|---|---|

| FX | Lognormal, Yield Vol | Percentage (e.g., 12%) | EUR/USD options |

| Interest Rates | Normal, Price Vol | Basis points (e.g., 50bps) | LIBOR caps/floors |

| Equities | Lognormal, Yield Vol | Percentage (e.g., 30%) | SPX options |

| Commodities | Hybrid | Both | Crude oil options |