Structured Products for Exchange Rate Hedging – Floor Forward

Structured Products for Exchange Rate Hedging – Floor Forward

Visit the Mathema Option Pricing System for foreign exchange options and structured product valuation!

Business Overview

The Floor Forward is the opposite of a Capped Forward. It sets a loss floor on top of a forward contract. For foreign exchange sales (corporate transaction direction), a call option is purchased on top of the forward sales contract to set a protection price, which is higher than the agreed price.

Selling a Floor Forward can also be seen as selling a forward + buying a call option. The forward selling price is worse than the market forward price, and the income from this can be used to purchase the call option, forming a zero-premium product.

Product Features

Compared to a standalone forward purchase, the Floor Forward offers a price advantage when the exchange rate falls. By purchasing a call option, if the price falls below the predetermined exchange rate, the company can choose to settle at the predetermined rate, locking in the loss floor. If the price does not fall below the predetermined rate, the company can choose not to exercise the option and settle at the market rate. During periods of significant exchange rate fluctuations, companies can purchase options that are highly likely to be exercised, paying a small premium to ensure they can exercise the option if the exchange rate falls to a certain level, thereby reducing hedging costs.

Pros and Cons Analysis (For Enterprises)

| Pros | Cons |

|---|---|

| The operational logic is relatively straightforward, eliminating the need for complex multi-leg combinations or precise predictions of volatility. This makes the strategy accessible to beginners with low trading experience requirements. Risk is capped, allowing investors to know in advance the maximum potential loss scale of the strategy, facilitating risk planning and capital management. If the underlying asset price moves significantly as anticipated (either rising or falling), investors can potentially achieve substantial returns by employing strategies such as "long forward + long put option" or "short forward + long call option." Profits are primarily derived from price differentials resulting from movements in the underlying asset, aligning with common profit logic and making it easy for investors to adopt and implement. | High initial cost. In environments with changing market volatility, the strategy may lack the flexibility to adjust or capture additional gains compared to strategies that rely on volatility. |

Case Study

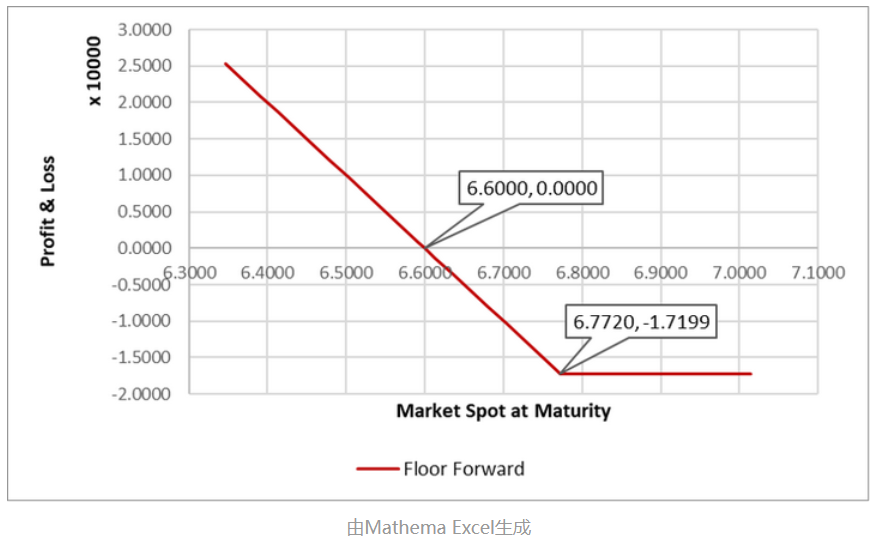

On February 3, 2019, the spot price was 6.550, and the 12-month forward price was 6.7032. An export company will receive $100,000 in 12 months and uses the 6-month forward exchange rate of USD/CNY as the cost rate for this export business, i.e., 6.60. The company and the bank agree to a price of 6.60 plus a floor of 0.1720, resulting in a rate of 6.7720. If the market price in 12 months is less than 6.7720, the company settles at 6.60; if it is higher, the company pays a fixed amount of CNY 172,000.

The components of the combined option are as follows:

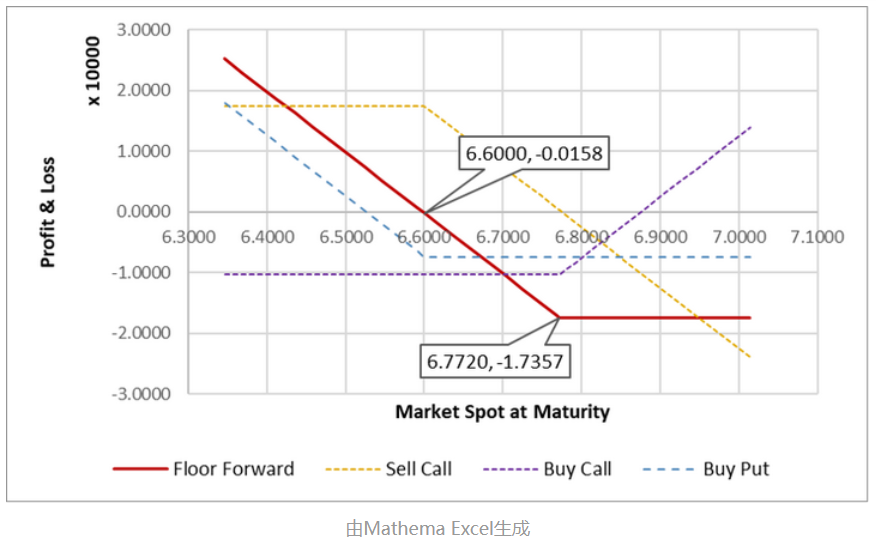

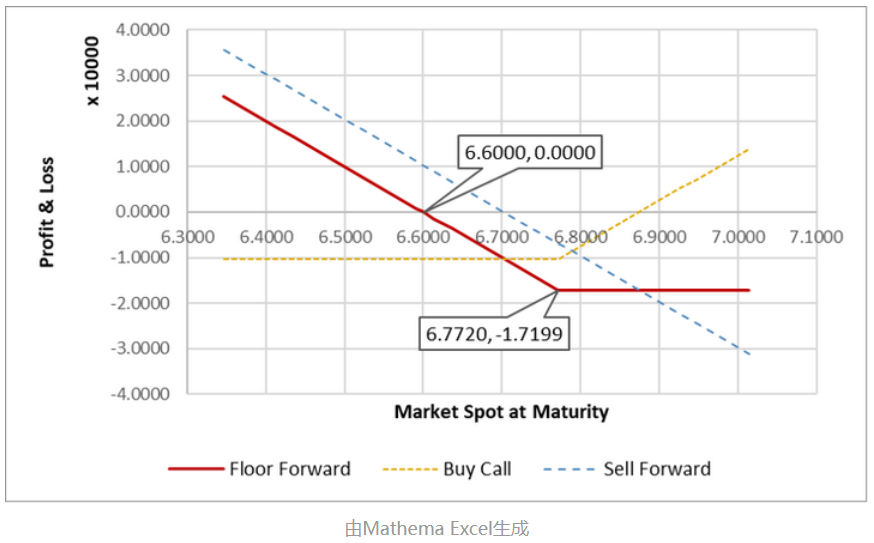

The profit and loss analysis of the Floor Forward as the exchange rate fluctuates is as follows:

The profit and loss analysis is shown in the figure below:

Pricing Analysis

For the company, selling a Floor Forward (selling foreign currency and buying CNY) can be broken down into selling a forward (selling foreign currency and buying CNY) + buying a call option (on foreign currency). A forward can also be decomposed into two options, so a Floor Forward can be constructed in two ways:

- Sell Forward @ Agreed Price + Buy Call Option @ Floor Price

- Sell Call Option @ Agreed Price + Buy Put Option @ Agreed Price + Buy Call Option @ Floor Price