Structured Products for Exchange Rate Hedging – Capped Forward

Structured Products for Exchange Rate Hedging – Capped Forward

Visit the Mathema Option Pricing System for foreign exchange options and structured product valuation!

Business Overview

The Capped Forward sets a profit cap on top of a forward contract. For foreign exchange purchases (e.g., USD/CNY), the cap price is higher than the agreed price by a specified margin. For foreign exchange sales, the cap price is lower than the agreed price by a specified margin. Here, the agreed price is the forward exchange rate agreed upon by both parties.

A Capped Forward can be seen as a combination of a forward contract and an option.

Product Features

Compared to a standalone forward purchase, the Capped Forward offers a price advantage. By selling a call/put option, the company earns an option premium, which is used to subsidize the forward transaction, resulting in a cheaper purchase/sale price. When exchange rates fluctuate within a narrow range, companies can sell options that are unlikely to be exercised, earning premiums and reducing hedging costs.

Pros and Cons Analysis (For Enterprises)

| Pros | Cons |

|---|---|

| Obtain a more favorable exchange rate by selling an option, reducing hedging costs. | Locks in a profit cap, eliminating the potential for gains from extreme exchange rate increases and missing out on benefits from extreme exchange rate decreases. |

Case Study

On February 3, 2019, the spot price was 6.5500, and the 1-year forward price was 6.7032. An export company will receive $100,000 in 1 year. The company and the bank agree to a price of 6.7766 (6.6000 + 0.1766). If the market price in 1 year is higher than 6.6000, the company will settle at 6.7766 (selling $100,000 at 6.7766). If the price is lower than 6.6000, the company will receive a fixed amount of 1,766 points (CNY 17,660).

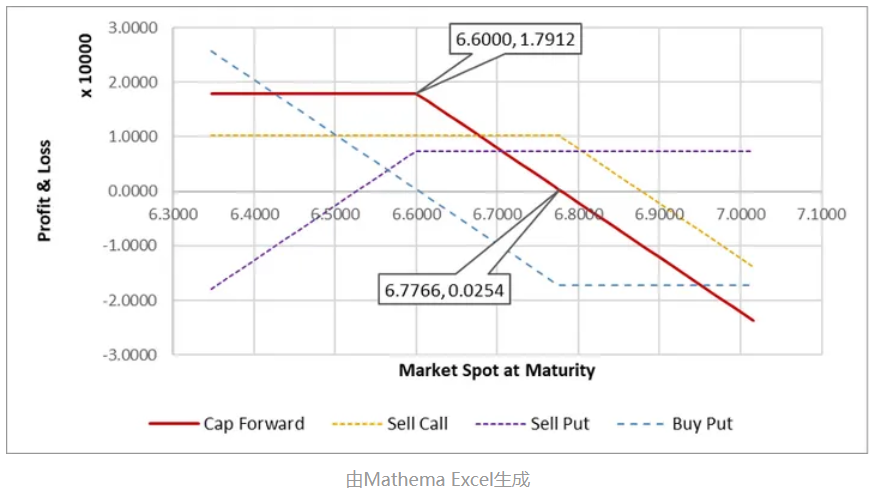

The components of the combined option are as follows:

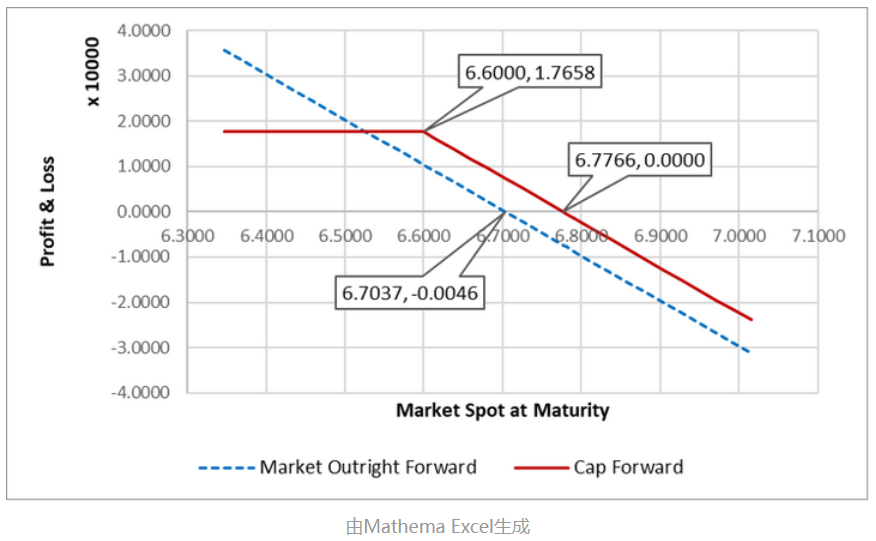

The profit and loss analysis of the Capped Forward as the exchange rate fluctuates is as follows:

The profit and loss analysis is shown in the figure below:

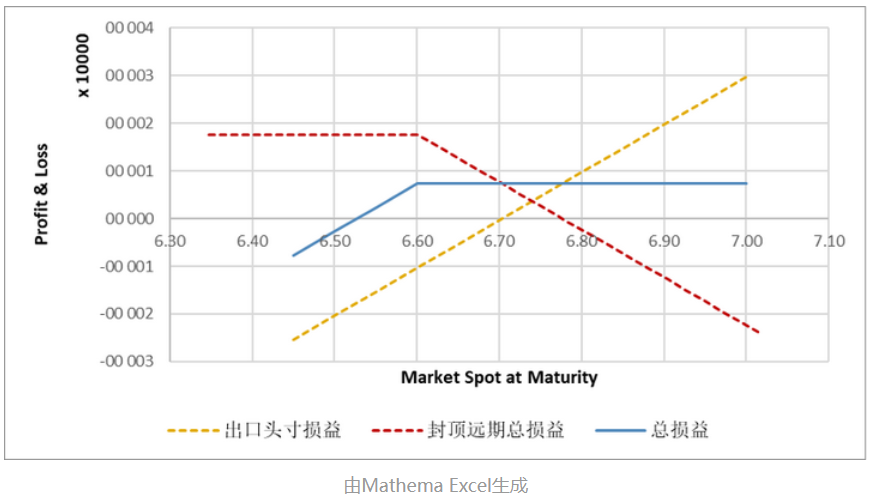

The comprehensive profit and loss (Capped Forward profit/loss + impact of exchange rate on export position) is as follows:

The profit and loss chart is as follows:

Pricing Analysis

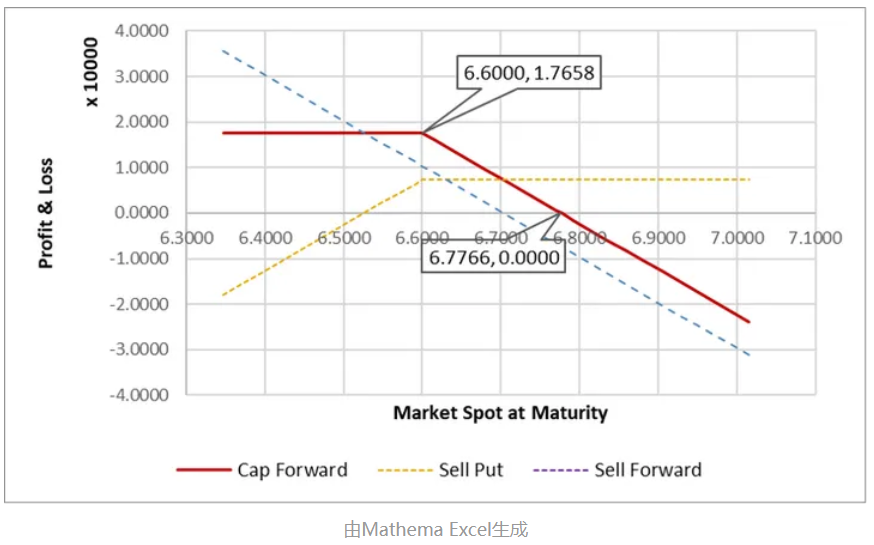

For the company, selling a Capped Forward (selling foreign currency and buying CNY) can be broken down into selling a forward (selling foreign currency and buying CNY) + selling a put option (on foreign currency). A forward can also be decomposed into two options, so a Capped Forward can be constructed in two ways:

- Sell Forward @ Agreed Price + Sell Put Option @ Cap Price

- Sell Call Option @ Agreed Price + Buy Put Option @ Agreed Price + Sell Put Option @ Cap Price