Structured Products for Exchange Rate Hedging – Range Forward

Structured Products for Exchange Rate Hedging – Range Forward

Visit the Mathema Option Pricing System for foreign exchange options and structured product valuation!

Business Overview

A Range Forward (also known as Risk Reversal) typically involves buying a call option and selling a put option, or selling a call option and buying a put option. The premiums of these options are generally equal, offsetting each other to form a zero-cost or low-cost options combination, which is one of the most distinctive features of the range forward strategy.

Product Features

When exchange rates exhibit range-bound fluctuations, the range forward strategy can effectively hedge against exchange rate depreciation risks while allowing companies to benefit from potential exchange rate appreciation within a predefined range. This helps companies save hedging costs.

Pros and Cons Analysis (For Enterprises)

| Pros | Cons |

|---|---|

| Protects against exchange rate appreciation risks within a certain range and locks in a fixed exchange rate for settlements. | If the exchange rate exceeds the upper limit, the cost will be higher than the market spot price. |

| Allows companies to enjoy some benefits from exchange rate depreciation. | Limited upside potential due to the capped exchange rate. |

| Zero or low premium (option fee). |

Case Study

On February 3, 2019, the spot price was 6.5500, and the 1-year forward price was 6.7032. An export company will receive $100,000 in 1 year and uses the 1-year forward exchange rate of USD/CNY as the cost rate for this export business, i.e., 6.7032. If the USD exchange rate rises, export revenue will increase, and vice versa. The company predicts that the USD/CNY exchange rate will fluctuate between 6.60 and 6.8695 over the next year. Therefore, the company can set a range forward with a cap rate of 6.8695 and a floor rate of 6.60, entering into a structured forward transaction with the bank.

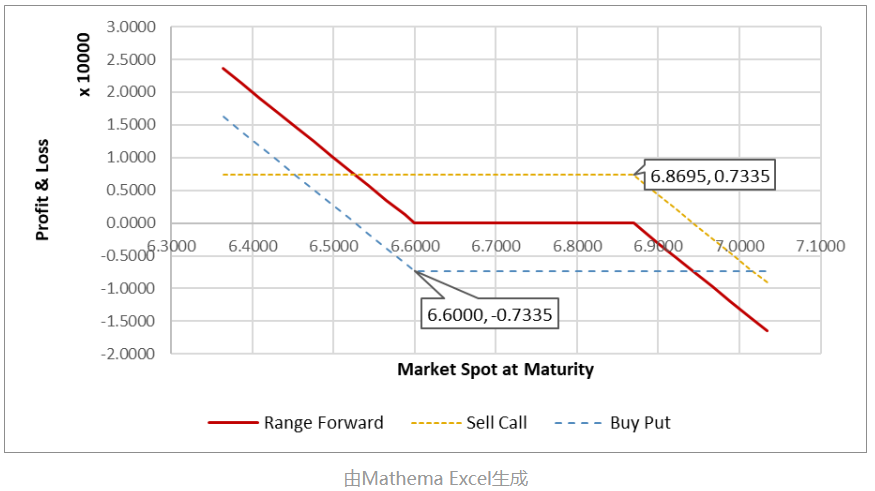

From the bank's perspective, this can be understood as the client buying a put option with a strike price of 6.60 and selling a call option with a strike price of 6.8695, assuming the option premiums are zero.

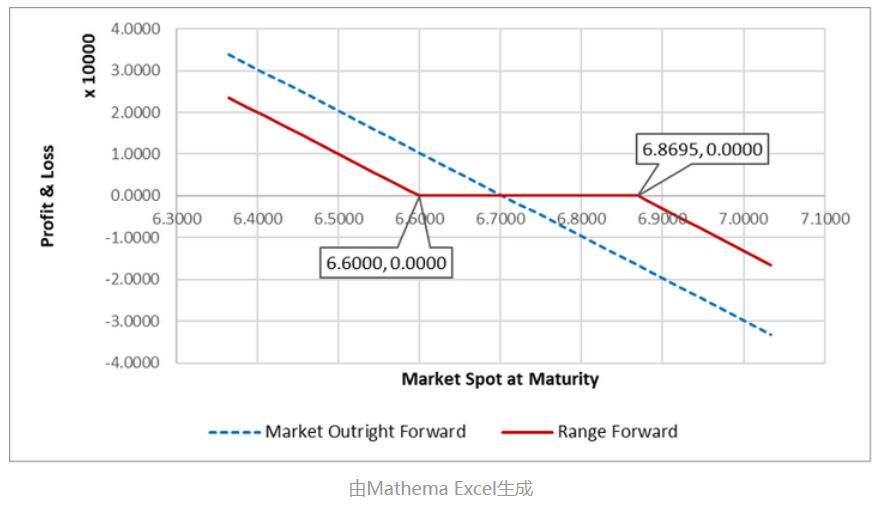

The payoff diagram of the range forward at expiration is shown below, along with the payoff diagram of a direct forward for comparison:

The transaction details are as follows:

At settlement, there are three scenarios:

- If the exchange rate is below 6.60, settle at 6.60.

- If the exchange rate is above 6.8695, settle at 6.8695.

- If the exchange rate is between 6.60 and 6.8695, both the company and the bank can choose not to settle.

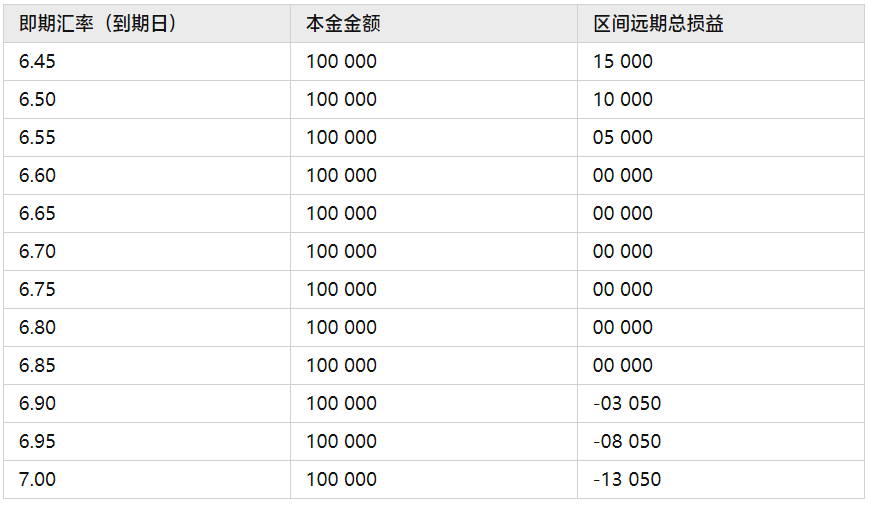

The profit and loss analysis of the range forward as the exchange rate fluctuates is as follows:

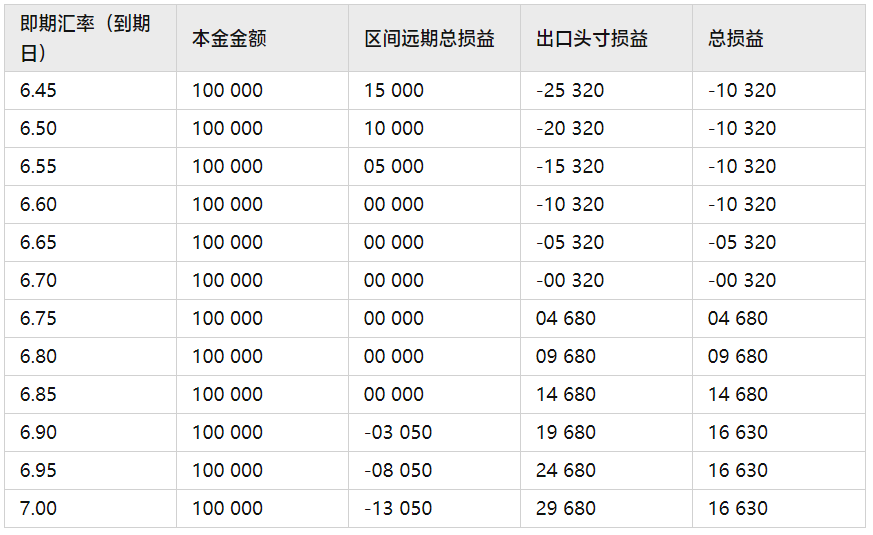

The comprehensive profit and loss (range forward profit/loss + impact of exchange rate on export position) is as follows:

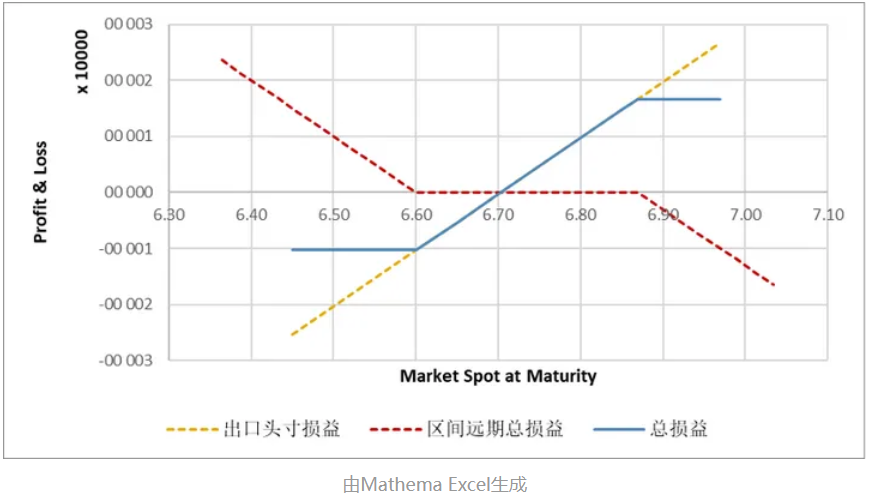

The comprehensive profit and loss chart (range forward profit/loss + impact of exchange rate on export position) is as follows:

Pricing Analysis

The pricing of a Range Forward depends on the currency pair, tenor, direction, and the upper or lower limit price selected by the client. The bank will then quote the corresponding lower or upper limit price. The option premium is typically zero.

This product can be decomposed into selling a call option and buying a put option, with the premiums of these options generally equal, as shown below:

The corresponding calculation formulas are as follows:

Scenario 1: Calculating Option Premiums

Calculate the prices of the call and put options separately and aggregate them.

Scenario 2: Calculating Strike Prices Based on Option Premiums (or Zero Premium)

Assuming the lower strike price ( K_1 ) (Down Strike) is determined, the upper strike price ( K_2 ) (Up Strike) can be calculated as follows:

Calculate the put option premium based on ( K_1 ):

Therefore, the call option premium should be:

Here, ( V_{sf} ) is the option premium.

Use a root-finding method (e.g., the bisection method) to derive ( K_2 ):