Basic Concepts of Interest Rates

Basic Concepts of Interest Rates

Visit the Mathema Option Pricing System, supporting FX options and structured product pricing and valuation!

The following is a detailed expansion and sorting of relevant concepts in the process of constructing interest rate curves, combined with definitions, formulas, characteristics, and application scenarios, in order to have a more comprehensive understanding of these important concepts commonly found in the interest rate market.

1. Zero-Coupon Rate

Definition

- The zero-coupon rate refers to the yield to maturity implied by a zero-coupon bond. A zero-coupon bond is a bond that does not pay periodic interest but pays the principal and interest in a lump sum at maturity.

- It is an interest rate with no intermediate cash flows, calculated solely based on the return from holding the bond until maturity.

Characteristics

- No Intermediate Payments: Only a single payment of principal and interest at maturity.

- Yield to Maturity: The zero-coupon rate directly reflects the return an investor earns by holding the bond until maturity.

- Foundation for Building the Term Structure: Zero-coupon rates are used to construct interest rate curves (e.g., the zero-coupon rate curve).

Formula

The relationship between the price of a zero-coupon bond and the zero-coupon rate:

Where:

- : Current price of the zero-coupon bond.

- : Face value of the bond.

- : Zero-coupon rate.

- : Time to maturity.

Applications

- Term Structure Construction: Calculating zero-coupon rates for different maturities using zero-coupon bond pricing.

- Present Value Calculation: Used to calculate the present value of future cash flows.

2. Spot Rate

Definition

- The spot rate refers to the risk-free interest rate for different maturities at the current moment. It is a manifestation of the zero-coupon rate, reflecting the market's pricing of funds for different maturities.

Characteristics

- Maturity Dependency: The spot rate varies with maturity, forming the term structure of interest rates.

- Market Benchmark: The spot rate is a crucial basis for pricing bonds, derivatives, and other financial instruments.

Formula

The relationship between the spot rate and the zero-coupon rate:

Here, the spot rate is directly equivalent to the zero-coupon rate .

Applications

- Bond Pricing: Using the spot rate to discount future cash flows.

- Derivative Pricing: Such as option pricing and swap pricing.

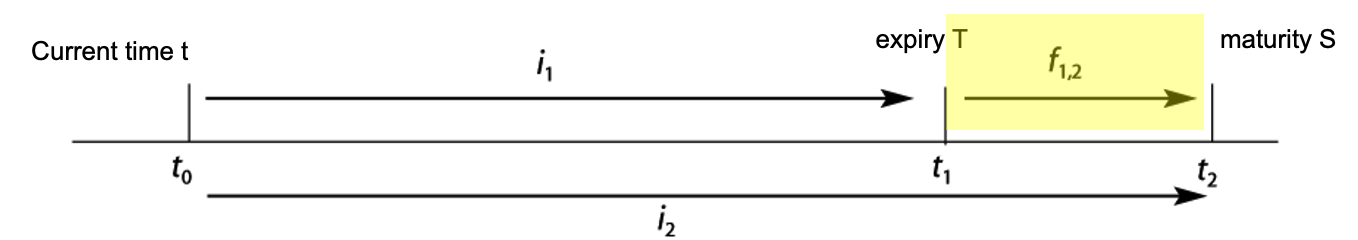

3. Forward Rate

Definition

- The forward rate refers to the interest rate starting at a future point in time, derived from the current spot rate. It represents the market's implied expectation of future interest rates.

- Forward rates are not directly observable but are calculated from spot rates.

Characteristics

- Implicit Nature: Forward rates reflect the market's expectations of future interest rates.

- Risk Hedging Tool: Used to lock in future borrowing costs or investment returns.

Formula

Under simple interest, the forward rate derived from spot rates:

Where:

- , : Spot rates for maturities and , respectively.

- : Forward rate from to .

Applications

- Bond Investment Strategies: Analyzing forward rates to predict future yield changes.

- Interest Rate Derivatives: Such as pricing forward rate agreements (FRAs) and interest rate swaps.

4. Yield to Maturity (YTM)

Definition

- The yield to maturity is the discount rate that equates the present value of a bond's future cash flows to its current price.

- It is a comprehensive yield measure that considers the coupon rate, market price, and time to maturity.

Characteristics

- Comprehensive: YTM is a comprehensive yield metric that reflects market price and bond characteristics.

- Non-Fixed: YTM fluctuates with changes in market prices.

- Iterative Calculation: YTM is typically calculated using numerical methods.

Formula

The relationship between bond price and yield to maturity :

Where:

- : Periodic coupon payment.

- : Face value.

- : Time to maturity.

Applications

- Bond Pricing: YTM is a key pricing metric for bond investments.

- Yield Comparison: Used to compare the investment value of different bonds.

5. Coupon Rate

Definition

- The coupon rate is the fixed interest rate set at the issuance of a bond, used to calculate the periodic coupon payments.

- The coupon rate is based on the bond's face value.

Formula

Calculation of periodic coupon payment :

Applications

- Interest Payments: Used to calculate the bond's cash flows.

- Bond Pricing: The coupon rate influences the bond's market price.

6. Coupon Rate in Interest Rate Swaps (IRS)

Definition

- In an interest rate swap (IRS), the coupon rate is the fixed rate paid by the fixed-rate payer.

- The coupon rate is typically equal to the par rate, which is the fixed rate that makes the swap's present value zero.

Characteristics

- Market-Driven Pricing: The coupon rate is an agreed-upon rate by market participants.

- Alignment with Par Rate: The swap rate is usually equal to the par rate.

7. Par Rate

Definition

- The par rate is the interest rate that makes the bond's current price equal to its face value.

- It reflects the market's discount rate and is a key reference for bond pricing.

Formula

The present value formula for the par rate:

When , is the par rate.

8. Discount Factor

Definition

- The discount factor is the present value coefficient of a future cash flow at the current moment.

- It directly reflects the time value of money and the level of interest rates.

Formula

Calculation of the discount factor :

Under continuous compounding:

Applications

- Bond Pricing: Used to discount future cash flows.

- Derivative Pricing: Widely applied in pricing models for options, futures, etc.

Summary and Comparison

| Concept | Definition | Characteristics | Applications |

|---|---|---|---|

| Zero-Coupon Rate | Yield to maturity of a zero-coupon bond | No intermediate payments, yield to maturity | Term structure construction, present value calculation |

| Spot Rate | Risk-free interest rate at the current moment | Maturity-dependent | Bond pricing, present value calculation |

| Forward Rate | Implied interest rate starting at a future point | Reflects market expectations of future rates | Interest rate derivatives, bond investment |

| Yield to Maturity | Discount rate equating bond's cash flow present value to its current price | Comprehensive yield, considers coupon, price, and maturity | Bond pricing, yield comparison |

| Coupon Rate | Fixed interest rate set at bond issuance | Fixed rate, used to calculate coupon payments | Bond cash flow calculation |

| Coupon Rate in IRS | Fixed rate paid by the fixed-rate payer in an IRS | Typically equals the par rate | Interest rate swap pricing |

| Par Rate | Interest rate making bond price equal to face value | Market discount rate | Term structure construction |

| Discount Factor | Present value coefficient of future cash flows | Closely related to interest rates | Bond pricing, derivative pricing |