Enterprise Exchange Rate Market Risk Management Strategy

Enterprise Exchange Rate Market Risk Management Strategy

Visit the Mathema Option Pricing System for foreign exchange options and structured product valuation!

Hedging or Speculation?

As market participants, enterprises can adopt any of the following four main risk management/investment strategies:

Hedging: Financial transactions have the same notional amount and maturity as the client's potential risk exposure. Companies can use financial transactions to eliminate the potential adverse effects of market risks.

Active Risk Management: Companies manage underlying risk exposures by leaving part or all of the exposure "open," meaning the financial transactions conducted do not fully cover the potential risk exposure in terms of maturity or amount. Active risk management results in a risk-taking level between hedging and speculation.

Speculation: Speculative transactions have little to no relation to potential risk exposure, as the sole purpose is to profit by taking on market risks. Investors may incur significant losses, including the entire premium paid for the transaction, depending on the outcome (e.g., if an option is not exercised).

Investment: Allocating funds to financial assets to achieve higher returns.

In summary, when deciding whether to engage in a financial transaction, enterprises must weigh the following aspects:

| Business Operations Exposed to Market Risks | Business Operations Not Exposed to Market Risks | |

|---|---|---|

| Access to Hedging Products | Hedging | Speculation |

| No Access to Hedging Products | Speculation | Natural Hedging |

If a company's business is significantly affected by specific exchange rate, interest rate, or commodity price fluctuations and does not engage in financial transactions, it can be considered a speculator. Conversely, if a company executes financial transactions without underlying risks, a transaction initially intended for hedging may become speculative. Natural hedging occurs when, for example, a company's income and expenses in a specific currency are equal over a period, eliminating the need for financial transactions to hedge risks. However, liquidity management remains important as the timing of foreign exchange income may not align with expenses.

It is important to note that a standalone financial transaction cannot be classified as hedging or speculation; it depends on the company's purpose and underlying risk exposure (financial risks related to core business operations). For example, if the parameters of a simple forward transaction (currency pair, direction, value date) do not match the underlying risk, it can be considered speculative. Conversely, even a complex forward-enhanced option structure can be used for hedging if the exposure direction, maturity, and currency pair align. Regarding notional amounts, if the notional amount does not exceed the risk exposure, the financial transaction is definitely a hedge. In cases of under-hedging, the unhedged notional amount can be considered a speculative position. If the notional risk of the financial transaction exceeds the risk exposure related to core business operations, it is recommended to close the additional amount and restructure the position to align the financial position with the underlying risk exposure based on notional risk. Financial transactions with notional amounts exceeding the underlying risk exposure are considered over-hedging or speculative in terms of additional notional amounts.

Using different exchange rate products can help enterprises identify risk exposures affecting their business, enabling them to manage market risks arising from core business operations through financial hedging transactions.

How to Plan Foreign Exchange Hedging Transactions Based on Market Position and Strategy?

Before engaging in hedging transactions, enterprises must define their optimal hedging strategy during the annual (or multi-year) planning process, considering their relative competitive position, profitability, and debt levels. It is worthwhile to compare target exchange rates, interest rates, and commodity prices with realistically expected rates to achieve the desired profitability. Additionally, potential market volatility scenarios should be studied to understand the extent to which the company is affected by changes in exchange rates, interest rates, or commodity prices, whether positively or negatively.

After identifying the market risks affecting core business operations and determining risk preferences, the next step is to select the most suitable risk management tools for the business situation.

The above analysis will help enterprises determine the hedging strategy to achieve the best results:

- Defensive: Define a guaranteed worst-case scenario and exclude any possibility of worse outcomes.

- Aggressive: Financial transactions must be profitable. If defensive hedging strategies are insufficient to achieve the target exchange rate, the primary goal of an aggressive strategy is to take risks to improve the available exchange rate level. In this case, the worst-case scenario will be unknown.

When defining a hedging policy, specific hedging objectives must also be determined. These objectives may include:

- Completely eliminating cash flow volatility in an absolutely safe manner.

- Defining a defensive level to partially eliminate cash flow volatility.

- Gaining some degree of profit from potential favorable market movements.

- Enhancing relative competitive advantage by maximizing cash flow value.

If only very low cash flow volatility is allowed, and in cases of intense market volatility, the company must define a defensive level—the worst-case scenario the business can withstand.

- Purchasing options can best protect against crisis situations, or consider products that clearly define the worst-case structure while leaving some room for limited profit from potential favorable market movements, such as partial forwards or forward extras.

- If cash flow volatility tolerance is low, conservative solutions such as defensive hedging strategies involving various forward transactions (FX Forward) and interest rate swaps (FX Swap) are preferable.

- In cases of high competitive pressure and relatively flexible cash flow, a more flexible hedging policy than purely defensive strategies should be considered, such as range forward transactions.

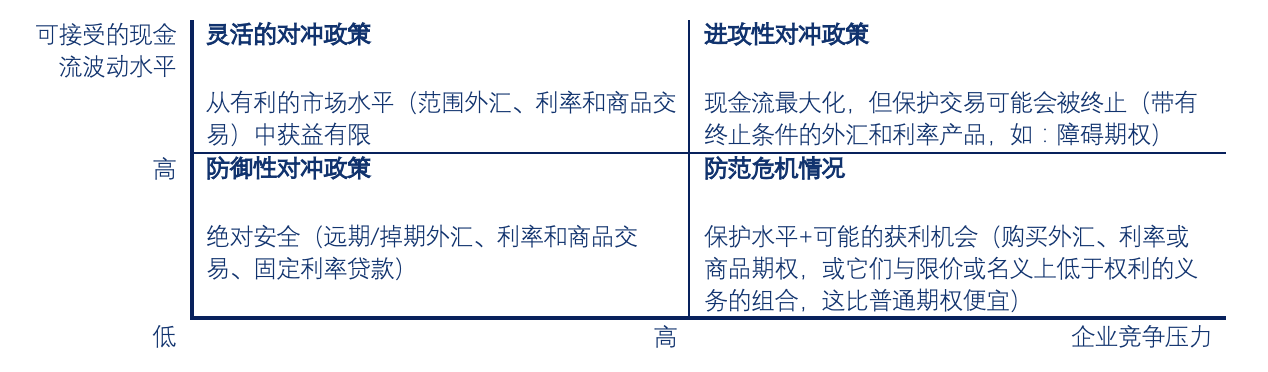

In the figure below, typical exchange rate and interest rate hedging policies, as well as products that can be used to successfully implement such strategies, are described along two dimensions: enterprise competitive pressure and acceptable cash flow volatility levels.

We categorize the following products for hedging foreign exchange, loan interest rates, currencies, and commodity index transactions according to the above classifications:

- Flexible Hedging Policies: Range forward, interest rate collar, commodity collar.

- Defensive Hedging Policies: FX forward, interest rate forward (IRF)/average forwards, FX and interest rate swaps, fixed-rate loans, commodity forwards and swaps, step-up interest rate swaps.

- Aggressive Hedging Policies: Seagull, boosted forward, boosted forward with compensation, extendible forward, reset forward, target profit forward (TARF), barrier interest rate options (buying barrier caps and floors), knockout interest rate collars (KO Cap or KI Floor).

- Crisis Protection Strategies: FX options (buying call and put options), interest rate options (buying caps and floors), swaptions, commodity options (buying call and put options).

Using aggressive hedging policies, the worst-case outcome cannot be fully determined, so it is not recommended to use such transactions alone.

How to Achieve Better Hedging Levels Than Forward Rates by Taking Partial Market Risks?

Beyond forward transactions, enterprises can choose products that offer better hedging levels than forward rates. However, the risks associated with achieving more favorable hedging levels than forwards must not be overlooked.

Typical methods to replace forward rates include:

- Protecting against adverse exchange rate movements while retaining some upside potential to benefit from favorable currency fluctuations (e.g., range forward).

- Ceasing protection beyond a certain exchange rate level (e.g., seagull forward).

- Incorporating leverage in financial transactions: If the notional value of the debt exceeds the related rights, better-than-forward rates can be achieved. In such solutions, it is crucial to note that the protection provided to the company only covers a portion of the amount to be hedged, meaning the company's risk is not fully hedged (e.g., participation forward). Conversely, if the rights (i.e., protection) align with the actual risk exposure, the resulting conversion obligation may exceed the actual exposure from business operations. In leveraged scenarios, it is strongly advised that the obligation amount should not exceed the company's total exposure. In such cases, the company is not over-hedged, but protection is only provided for amounts below the actual risk, which still includes the company's risk. In cases of significant exchange rate fluctuations, if the notional value of the rights exceeds the notional value of the obligations (e.g., participation forward), the company may achieve a better price level at maturity. In this scenario, the company enjoys full protection against adverse exchange rate movements while benefiting to some extent from favorable exchange rate movements.

- Incorporating knock-in levels in financial transactions: Hedging levels can also become better than forward rates if certain conditions are met, typically at rates lower than forward rates, triggering the company's obligations (e.g., forward extra).

- Incorporating knock-out levels in financial transactions: If the protection for the entire structure can be terminated upon meeting certain conditions during the term, the company can achieve a better hedging level. However, in this case, the company faces the risk that protection may cease precisely when it is most needed, after which the risk can only be hedged in the market at rates lower than the original forward rate. Such knock-out levels can be defined as specific interest rate levels (e.g., boosted forward) or maximum profit targets (e.g., target profit forward).

In conclusion, when selecting the most suitable option strategy for your purpose, it is essential to understand the potential additional risks you are taking to achieve a more flexible and/or favorable hedging level than the applicable forward rate.

How to Choose Between Micro Hedging and Macro Hedging?

Methods for managing company risks through financial transactions are divided into micro hedging and macro hedging.

Micro Hedging: Hedges the expected amount to be received on a specific date, covering all receivables in this transaction. When the expected foreign currency amount is received on the specified date, the company can convert it into the local currency at the exchange rate applicable to the financial transaction. If receivables are delayed, the company can roll over the transaction using a swap transaction (FX Swap). In micro hedging, financial transactions are typically settled in full, meaning the company actually converts at the exchange rate applicable to the financial transaction.

Micro hedging should be used if a company has few foreign exchange-related transactions but large notional amounts occurring on relatively confirmed dates.

Macro Hedging: When a company has only a rough estimate of the size of monthly foreign exchange income for the next year and intends to convert it into the local currency, and this income is characterized by small amounts and high frequency. 1) In this case, it is recommended that the company hedge the total monthly income on a specific date each month, regardless of the specific date the foreign currency is received. 2) The company can also hedge the annual income at an average exchange rate, where the average hedging level is the weighted average of the exchange rates calculated for each month's maturity date based on the expected monthly amounts. Subsequently, if the expected amounts are received each month in the optimistic scenario, the company can convert them at the spot exchange rate at those times. The financial transaction concluded on a specific date in the month will be settled on a net basis, meaning the company and the bank will settle the exchange rate profit or loss for the entire month's amount in cash on the maturity date. The resulting profit or loss, combined with the smaller monthly amount converted into the local currency at the current spot exchange rate, yields a financial result roughly equivalent to the company converting at the hedging exchange rate for the month. If the timing of cash flows is difficult to predict but the amounts are more or less predictable, macro hedging simplifies the settlement process and provides more comprehensive annual foreign exchange risk management than micro hedging.

Macro hedging should be used if the company typically deals with a large number of small notional amounts or if the timing of these amounts is uncertain.