Structured Products for Exchange Rate Hedging – Ratio Forward

Structured Products for Exchange Rate Hedging – Ratio Forward

Visit the Mathema Option Pricing System for foreign exchange options and structured product valuation!

Business Overview

The Ratio Forward (or Participating Forward) is a hedging strategy that allows companies to achieve a contract price better than the direct forward rate if their market outlook is correct. For example, this product structure can involve selling a certain multiple (participation ratio) of call options on top of a forward contract (e.g., buying one unit of forward). The premium from selling these options can be used to obtain a more favorable contract price from the bank.

Notes

- In many bank-offered products, this type of forward is often referred to as a Participating Forward, with the contract price also known as the Worst Case Rate (WCR). The option ratio is also called the Participation Level or Participation Rate.

- The term Ratio Forward is sometimes used to describe forwards with knock-in or knock-out features.

Product Features

This product primarily uses the premium from selling options to subsidize the agreed execution price at the outset, allowing clients to obtain a better exchange rate than the initial forward rate. However, it is important to note that the settlement amount at maturity is uncertain, as it could be either one or two times the foreign exchange amount.

Pros and Cons Analysis (For Enterprises)

| Pros | Cons |

|---|---|

| Flexible settlement amount, providing protection against exchange rate appreciation risks within a certain range and offering a better exchange rate than the forward rate. | The settlement amount is uncertain, potentially being one or two times the foreign exchange amount. |

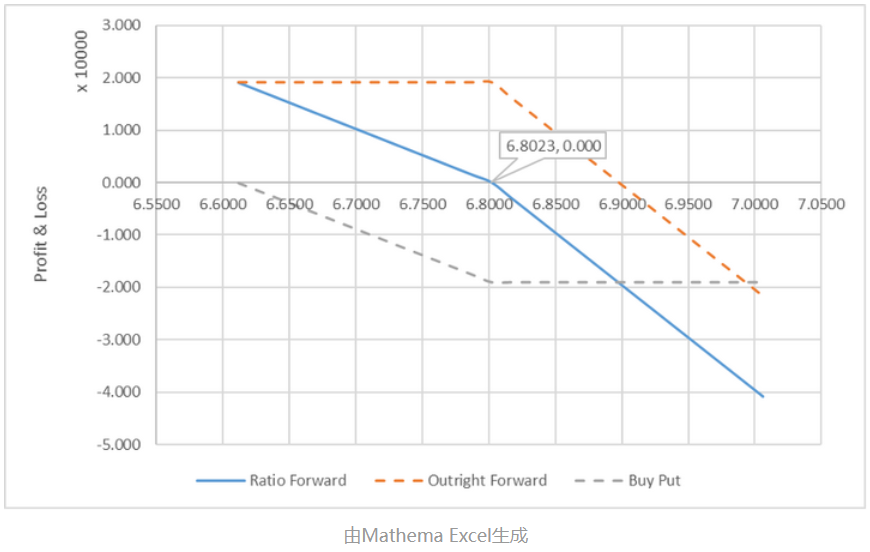

Case Study

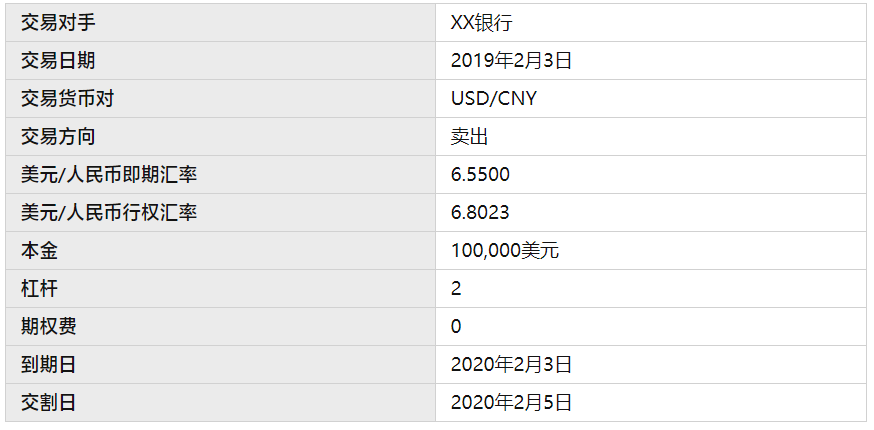

On February 3, 2019, the spot price was 6.5500, and the 1-year forward price was 6.7038. An export company expects to receive $100,000–$200,000 in 1 year and uses the 1-year forward exchange rate of USD/CNY as the cost rate for this export business, i.e., 6.7038. The company and the bank agree to a ratio forward at 6.8023 (subsidizing the option premium into the execution price). If the exchange rate in 1 year is below 6.8023, the company settles $100,000; if it is above 6.8023, the company settles $200,000.

The components of the combined option are as follows:

The profit and loss analysis of the Ratio Forward as the exchange rate fluctuates is as follows:

The profit and loss analysis is shown below:

The comprehensive profit and loss (Ratio Forward profit/loss + impact of exchange rate on export position) is as follows:

Pricing Analysis

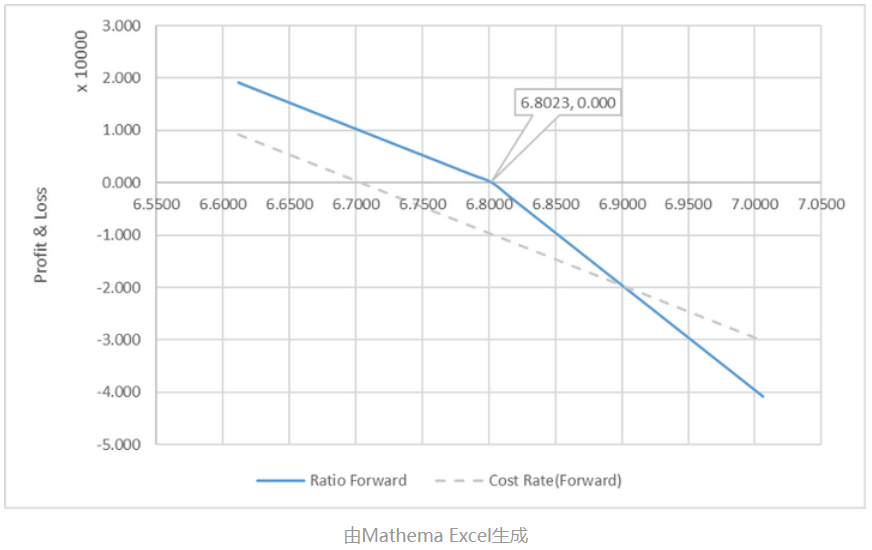

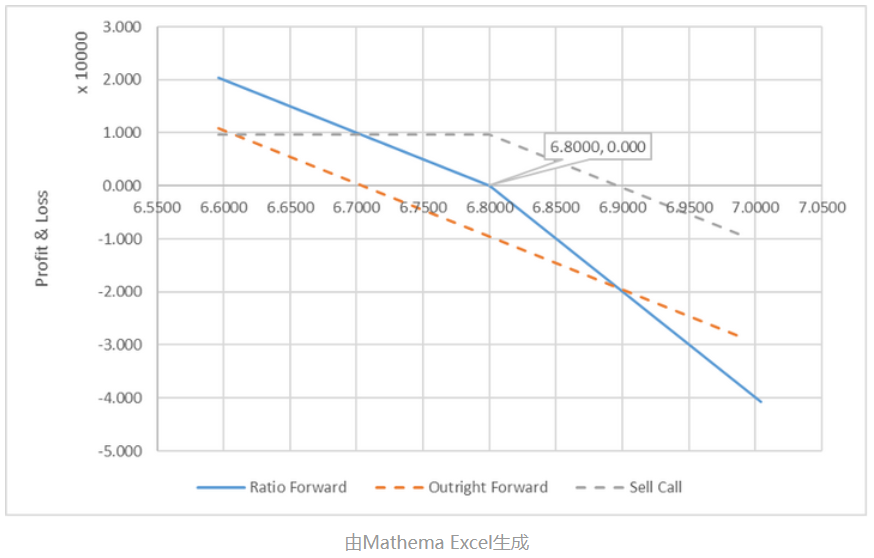

For a company selling foreign exchange, a Ratio Forward can be constructed in two ways (using the sell direction as an example):

Method 1: Decompose into selling a forward + selling a call option (with a 2x notional amount), with an option premium of 0, as shown below:

Method 2: Decompose into selling 2x call options + buying a put option (with a 2x notional amount), with an option premium of 0, as shown below:

Note: The strike prices of the Ratio Forward constructed by the two methods may differ slightly. In principle, if the call-put parity holds, the strike prices should be the same. However, if there are arbitrage opportunities in the market, the strike prices of the Ratio Forward constructed by the two methods may differ.