Foreign Exchange Asian Options

Foreign Exchange Asian Options

Visit the Mathema Options Pricing System for foreign exchange options and structured product pricing and valuation!

On November 26, 2021, the State Administration of Foreign Exchange (SAFE) issued the Notice on Measures to Support Market Entities in Foreign Exchange Risk Management (Draft for Comments), which stated:

"Banks are allowed to offer new products in the client foreign exchange market, including vanilla American options, Asian options, and their combinations for RMB foreign exchange. Banks already qualified for client options business may independently launch these new products."

Taking this opportunity, let’s briefly introduce foreign exchange Asian options.

What are Asian Options?

Asian options (also known as average rate options) are a special type of option contract where the payoff depends on the average exchange rate over a specified period, rather than the spot price at expiration (as in European or American options).

Asian options are generally suitable for the following scenarios:

- Focus on average exchange rates over a period: Useful for businesses with recurring foreign exchange exposures.

- Avoid manipulation of single price points: Reduces the risk of price manipulation at a specific time.

- Mitigate high volatility: Smooths out extreme fluctuations in exchange rates.

- Address low liquidity markets: Provides more efficient pricing in markets with thin trading volumes.

Advantages of Asian Options

One key advantage of Asian options is that they reduce the risk of market manipulation at expiration, as the final payoff is determined by the average price over a period. These options offer market participants opportunities to limit risks and enhance profits. By utilizing foreign exchange Asian options, businesses can protect themselves from adverse exchange rate movements.

Additionally, because Asian options use the average exchange rate, they inherently reduce volatility, making them less expensive than European or American options. For example, a one-month Asian option typically costs about 60% of a European option.

Structure of Asian Options

Asian options can be categorized based on the average price type:

- Average Strike (Floating Strike):

- The strike price is determined by the average price over the observation period.

- Average Rate (Fixed Strike):

- The payoff is determined by the difference between the average price over the observation period and a fixed strike price.

The average price calculation can be either:

- Arithmetic Average: The arithmetic mean of the observed prices.

- Geometric Average: The geometric mean of the observed prices.

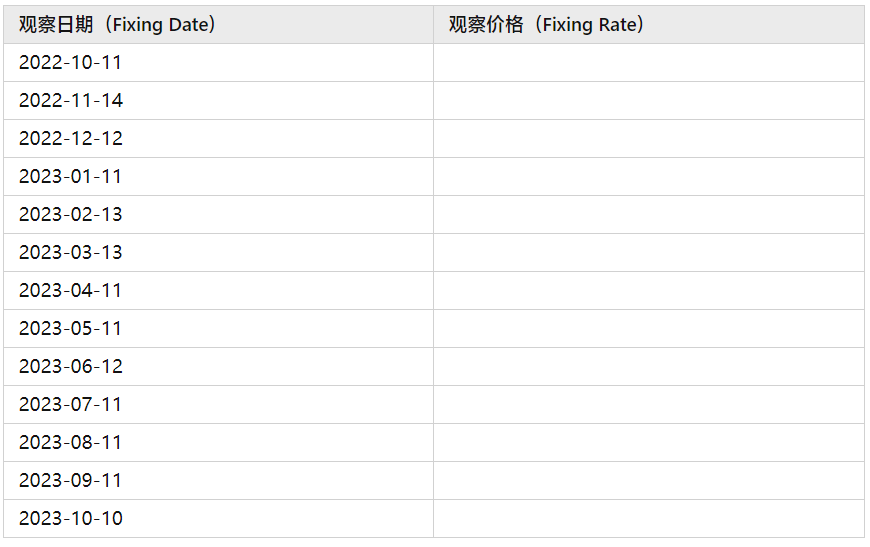

The observation period is defined by:

- Start Date (Average Start): The beginning of the observation period.

- End Date (Average End): Typically the expiration date of the contract.

- Frequency: Daily, weekly, monthly, quarterly, etc.

Example of an Asian Option Contract

Observation Period:

Further Reading on Asian Options

For more details on Asian option pricing principles, refer to:

We offer Asian option solutions: