Structured Products for Exchange Rate Hedging – Forward Extra

Structured Products for Exchange Rate Hedging – Forward Extra

Visit the Mathema Option Pricing System for foreign exchange options and structured product valuation!

Business Overview

The Forward Extra (also known as Shark Forward Extra) involves buying a put option and selling an up-and-in call option for companies selling foreign exchange (e.g., selling USD). Both options have the same strike price.

Product Features

This option allows companies to benefit significantly from interest rate declines (below the strike price) and provides protection against price increases within a certain range (from the strike price to the knock-in price). However, if the price exceeds the knock-in price, the company is obligated to sell at the strike price.

Pros and Cons Analysis (For Enterprises)

| Pros | Cons |

|---|---|

| Ensures the worst-case settlement rate (strike price or settlement price) and protects against price increases within a certain range (from the strike price to the knock-in price). | The settlement price (strike price) is slightly worse than the forward price. |

Case Study

On February 3, 2019, the spot price was 6.5500, and the 1-year forward price was 6.7038. An export company expects to receive $100,000 in 1 year and uses the 1-year forward exchange rate of USD/CNY as the cost rate for this export business, i.e., 6.7038. The company and the bank agree to a Forward Extra with a contract price of 6.6985 and a knock-in price of 6.9000. If the exchange rate in 1 year is below 6.6985, the company settles at 6.6985; if it is above 6.6985 but below 6.9000, the company can settle at the market rate; if it exceeds 6.9000, the company is obligated to settle at 6.6985.

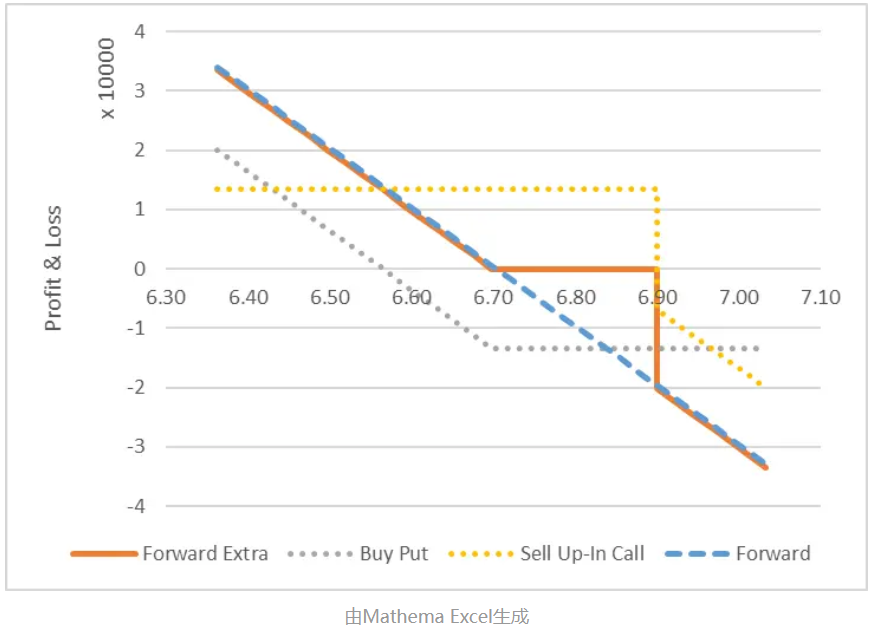

The components of the combined option are as follows:

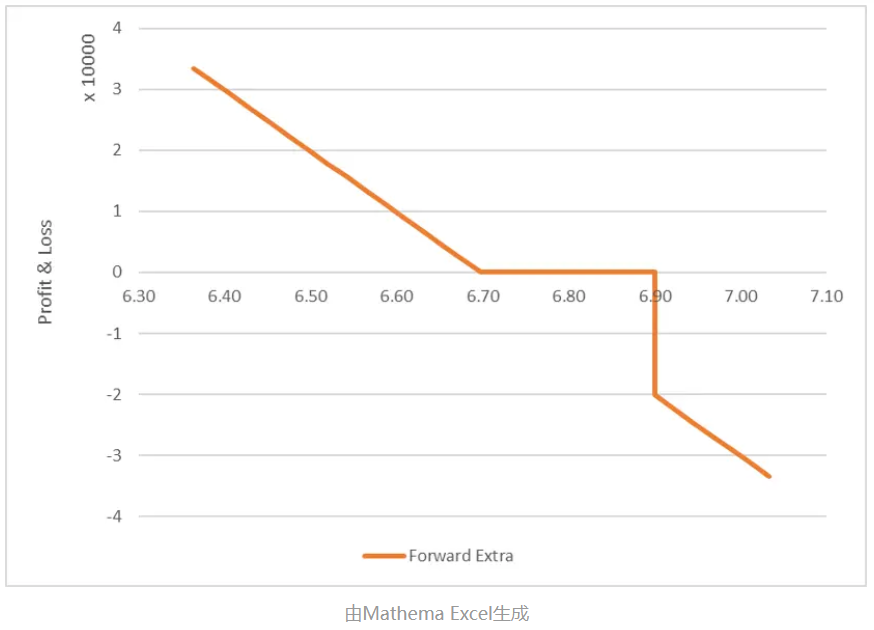

The profit and loss analysis of the Forward Extra as the exchange rate fluctuates is as follows:

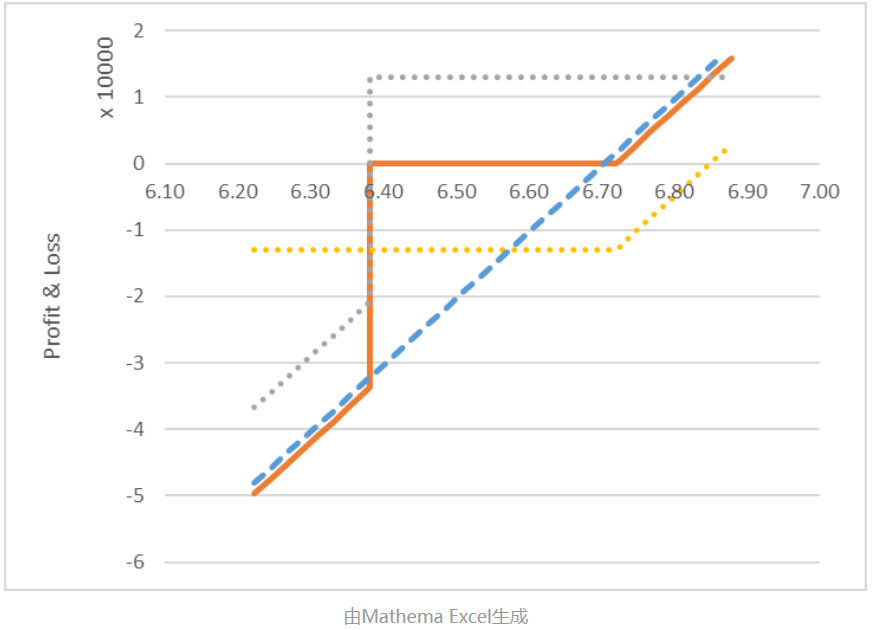

The profit and loss analysis is shown below:

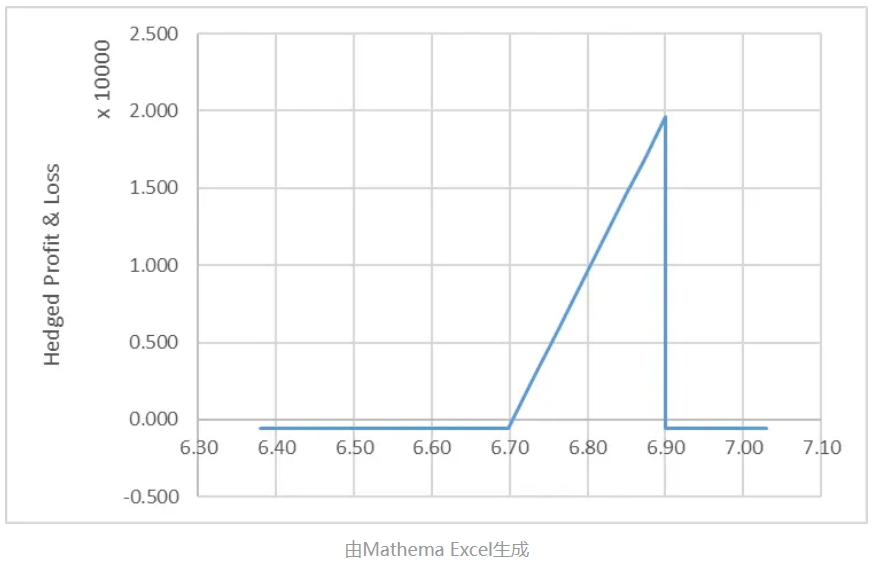

The comprehensive profit and loss (Forward Extra profit/loss + impact of exchange rate on export position) is as follows:

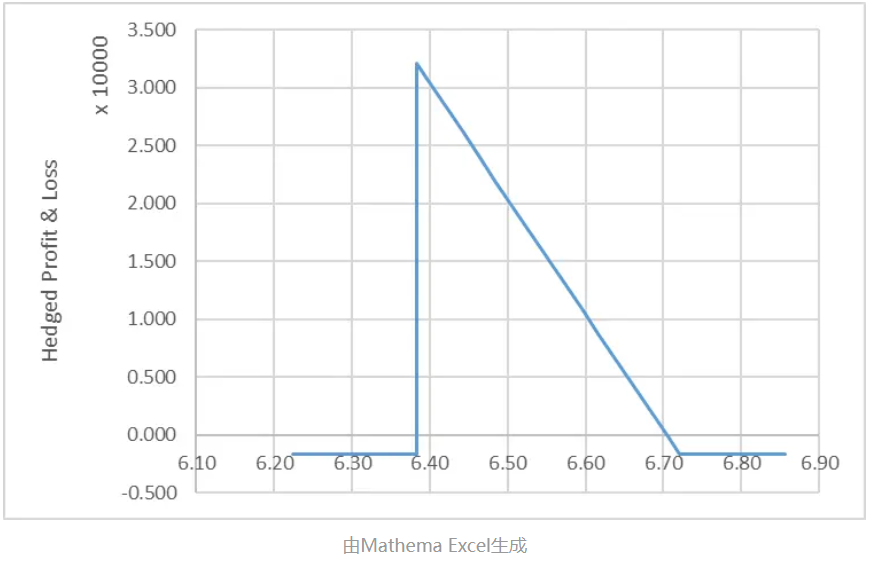

The overall profit and loss chart after hedging (relationship between hedging profit/loss and the spot exchange rate at maturity) is shown below:

The chart resembles a shark fin, which is why the Forward Extra is also called Shark Forward Extra.

Pricing Analysis

For companies selling foreign exchange, the Forward Extra product involves buying a put option and selling an up-and-in call option, with both options having the same strike price and maturity date.

For importers (buying foreign exchange), the Forward Extra product involves selling a call option and buying a down-and-in put option.

For importers, the overall profit and loss chart after hedging (relationship between hedging profit/loss and the spot exchange rate at maturity) is shown below: